You found a great factory price, but hidden costs are destroying your profit margins. Unexpected fees can turn a profitable project into a financial nightmare. I'll show you how to calculate the total landed cost1 accurately.

To calculate total landed cost, you must add the product cost to all logistics expenses. This includes shipping, customs duties2, insurance, and local delivery fees. Understanding these components ensures you know the true cost per unit before you commit to an order.

I've seen many designers like you, Jacky, focus only on the factory quote. It's a common mistake. But the price your supplier gives you is just the beginning of the story. To truly understand your project's profitability, you need to look at the bigger picture. Let's break down what that really means.

The factory's quoted price is the final cost of your product.Falso

The factory price (especially EXW or FOB) does not include shipping, customs, insurance, or local delivery, which can add 20-40% to the total cost.

Total landed cost includes all expenses to get a product from the factory to your warehouse.Verdadeiro

It's a comprehensive calculation covering the product, shipping, customs duties, taxes, insurance, and any other fees incurred during transit.

Why is the Factory Price Only Half the Story?

That amazing per-unit price from the factory looks too good to be true. It probably is. Hidden fees can quickly double your initial cost. Let's uncover these costs so your budget remains intact.

The factory price, often quoted as EXW or FOB, only covers the cost of the goods and sometimes transport to the port. It excludes international shipping, insurance, customs duties, and final-mile delivery. These additional expenses make up the other half of your total landed cost.

When I first started my trading company, I made this mistake. I'd get a fantastic price from a supplier and think I'd hit the jackpot. Then the bills started rolling in: freight charges, port handling fees, customs clearance, and more. The final cost was way higher than I planned. This is why understanding Incoterms3 is so critical. These are the international rules that define who pays for what.

Understanding Key Incoterms

- EXW (Ex Works): The supplier's only job is to have the goods ready at their factory. You are responsible for everything else: picking it up, trucking it to the port, shipping, customs, and final delivery. This gives you control but also maximum risk and cost responsibility.

- FOB (Free On Board): This is the most common term for a reason. The supplier handles getting the goods packaged, cleared for export, and loaded onto the ship at the origin port. From that point on, it's your responsibility. It's a good balance of cost and control.

- DDP (Delivered Duty Paid): The supplier handles everything, right to your door. It's the easiest option, but you pay a premium for this service, and you lose control over the logistics process. The supplier bakes a hefty margin into this price.

Choosing the right Incoterm is your first step in controlling costs. For most importers, FOB is the sweet spot.

DDP (Delivered Duty Paid) is always the cheapest shipping option for the buyer.Falso

DDP is the lowest risk but often the most expensive option, as the supplier includes a significant markup for managing the entire logistics process and assuming all the risk.

FOB (Free On Board) is the most common Incoterm for overseas sourcing.Verdadeiro

FOB offers a good balance of cost and control for the importer, making it a popular choice. The supplier handles origin costs, and the buyer controls the main international shipping leg.

What are the 4 Key Components of Landed Cost?

You know there are extra costs, but you're not sure what they are. Guessing at these costs can lead to major budget overruns and kill your profit margin. I'll break down the four essential components.

The four key components of landed cost are: 1) the product cost from your supplier, 2) shipping and freight charges4, 3) customs duties, taxes, and fees, and 4) local handling and delivery costs. Accurately estimating each is crucial for a reliable final cost.

To get a true picture of your costs, you need to think beyond the product itself. Let's break down these four pillars. I've seen projects fail because one of these was overlooked.

The Four Pillars of Landed Cost

- Product Cost: This is your starting point, the price you negotiate with your supplier. It's determined by your Incoterm (e.g., the FOB price).

- Shipping & Freight: This is the cost to move your goods from the origin port to the destination port. It includes ocean or air freight, insurance, and various surcharges. Remember, shipping is a volume game. A full container is much cheaper per unit than a small pallet.

- Customs & Duties: This is what you pay your government to import the goods. It's calculated based on the product's value and its HS Code5. A wrong HS code can be a costly mistake.

- Local & Port Charges: Once the goods arrive, there are still more costs. These include destination port fees, customs brokerage fees, and trucking from the port to your final warehouse. Don't forget these "last mile" costs.

Each of these components has its own variables, but you must account for all four.

The HS Code for a product is optional for international shipping.Falso

The Harmonized System (HS) Code is a mandatory international standard for classifying traded products. It is used by customs authorities worldwide to determine the correct duty and tax rates.

Shipping a full container (FCL) is generally more cost-effective per unit than shipping a partial container (LCL).Verdadeiro

FCL (Full Container Load) offers economies of scale. While the total cost is higher, the cost per cubic meter or per unit is significantly lower than LCL (Less than Container Load) shipping.

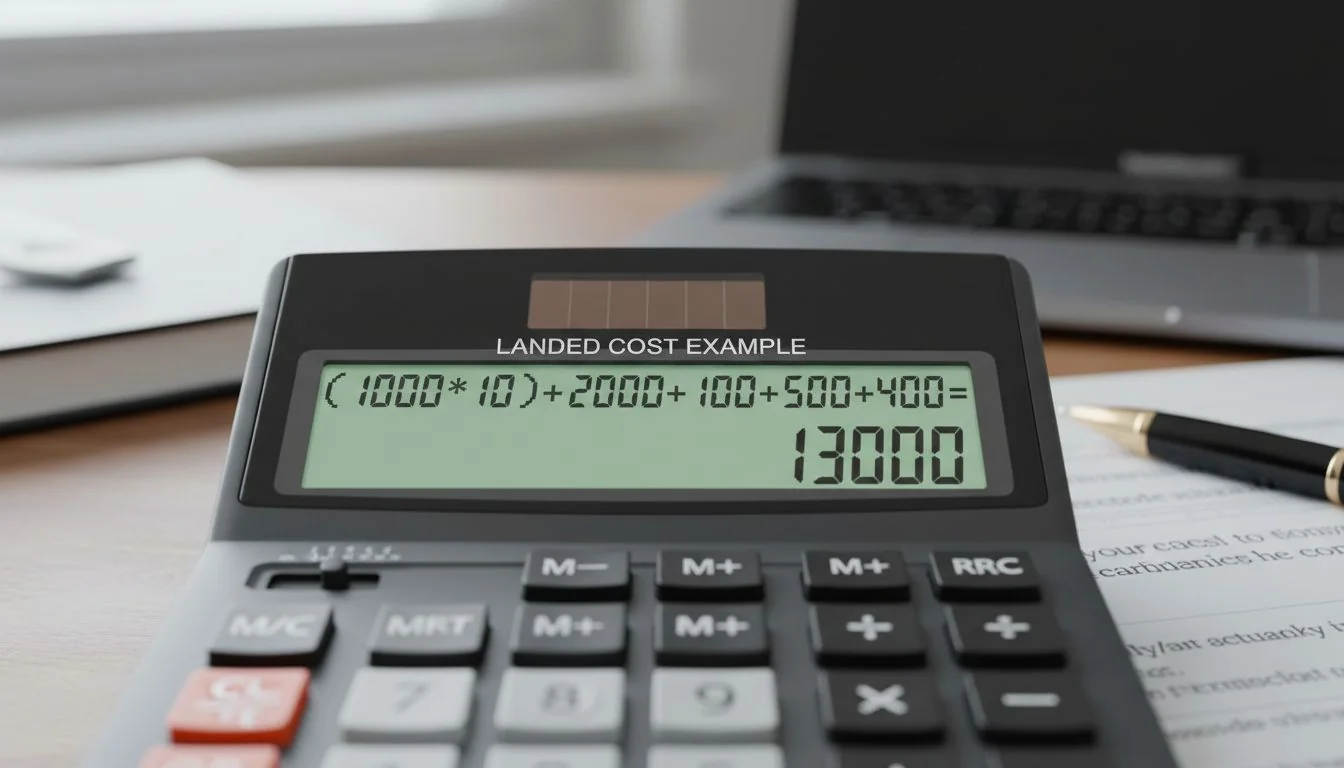

Can You Show a Step-by-Step Calculation Example?

The theory is clear, but applying it to a real order feels complicated. Without a practical example, you might miscalculate and make a costly ordering decision. Let's walk through a simple, step-by-step calculation.

Let's calculate the landed cost for 1,000 units at $10/unit (FOB). Add ocean freight ($2,000), insurance ($100), customs duty (5% of product cost = $500), and local delivery ($400). The total landed cost is $13,000, or $13 per unit.

Seeing the numbers makes it real. Let's imagine you're Jacky, importing a new plastic component for a consumer electronics project. You need to know the true cost per unit before you can set your own pricing.

Sample Landed Cost Calculation

Here's the scenario:

- Product: 5,000 plastic enclosures

- Supplier's Quote: $4.00 per unit, FOB Shanghai

- HS Code: 3926.90.99 (which we'll say has a 3% duty rate in Canada)

Here's how we break it down:

| Componente de custo | Calculation | Custo |

|---|---|---|

| 1. Product Cost | 5,000 units x $4.00/unit | $20,000 |

| 2. Shipping & Freight | Ocean Freight (FCL) + Insurance | $3,500 |

| 3. Customs & Duties | (Product Cost x Duty Rate) + Broker Fee | ($20,000 x 3%) + $300 = $900 |

| 4. Local Charges | Port Fees + Inland Trucking | $250 + $450 = $700 |

| Total Landed Cost | Sum of all costs | $25,100 |

Now, to find the most important number:

- Landed Cost Per Unit: $25,100 / 5,000 units = $5.02 per unit

As you can see, the actual cost is over 25% higher than the initial $4.00 factory price. This is the number you need to use for your profitability analysis6.

Customs duties are calculated based on the shipping cost.Falso

Customs duties are typically calculated as a percentage of the commercial value of the goods (the product cost), not the shipping cost. This value is often referred to as the CIF value in some countries.

The landed cost per unit is the total landed cost divided by the number of units.Verdadeiro

This final calculation gives you the true cost for each individual item, which is essential for determining pricing, profit margins, and overall project viability.

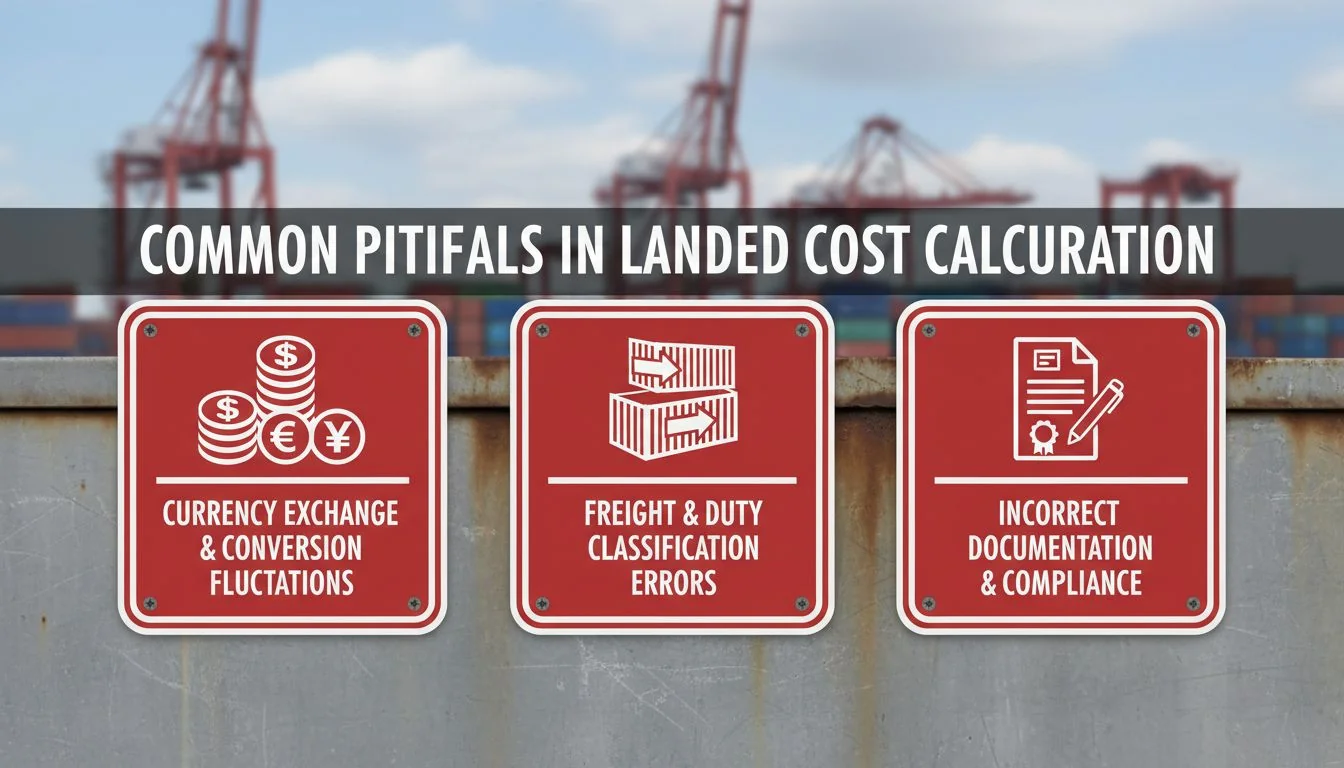

What are the Common Pitfalls to Avoid?

You've calculated your landed cost, but you're worried you missed something. Small oversights can lead to surprise bills, customs delays, and eroded profits. I'll highlight the most common traps so you can avoid them.

Common pitfalls include ignoring currency fluctuations, using the wrong HS code, underestimating shipping volume costs (LCL vs. FCL), and forgetting "last mile" fees like port charges and local trucking. Being aware of these traps is key to accurate budgeting.

Experience is a great teacher, but it can be an expensive one. I learned some of these lessons the hard way. Here are the mistakes I see designers and project managers make most often.

Top 3 Costly Mistakes

- Ignoring Currency Risk: You agree on a price in USD, but your supplier's invoice is in Chinese RMB. If the exchange rate shifts between when you place the order and when you pay, your cost in USD can increase unexpectedly. My advice: Try to lock in your price in USD or your home currency. If you must pay in a foreign currency, budget for a potential 3-5% fluctuation just to be safe.

- Trusting a "Too Good to Be True" Shipping Quote: Some freight forwarders will give you a very low initial quote that only covers the port-to-port ocean freight. They leave out destination port fees, customs clearance fees, and other charges that you only discover upon arrival. Always ask for a "door-to-door" or "all-in" quote to see the full picture.

- Not Optimizing Your Order Volume: The cost to ship one small pallet (LCL - Less than Container Load) can be shockingly high per unit. You're sharing container space, and the handling fees are significant. I always tell my clients to think about how many units fit in a 20ft or 40ft container. Ordering enough to fill a container (FCL - Full Container Load) dramatically lowers your per-unit shipping cost and, therefore, your landed cost.

Currency exchange rates are fixed and do not affect your final cost.Falso

Exchange rates fluctuate daily. If you pay your supplier in their local currency, a shift in the rate between the order date and payment date can significantly change your final cost.

Asking for a 'door-to-door' shipping quote helps avoid hidden fees.Verdadeiro

A door-to-door quote is more comprehensive and should include all charges from the factory to your warehouse, reducing the risk of surprise costs at the destination port.

How Does a Reliable Partner Make This Easier?

Juggling suppliers, freight forwarders, and customs brokers is complex and time-consuming. One misstep can cause costly delays and immense frustration. A good partner can manage this complexity for you, saving you headaches.

A reliable partner, like a good sourcing agent or customs broker, simplifies the process. They handle logistics, ensure correct paperwork like the HS code, and troubleshoot issues. Their expertise is an investment that prevents costly mistakes7 and delays.

As a designer, your expertise is in creating great products, not in navigating global logistics. This is where having the right people on your team becomes invaluable. I built my trading company on this principle: being the reliable partner my clients could trust.

The Value of a Good Customs Broker

While it's an added line item on your cost sheet, a good customs broker is worth their weight in gold. Don't try to save money here.

- Conformidade: They ensure all your paperwork is correct and that you're compliant with all import regulations. This prevents fines and legal trouble.

- Problem Solving: When a shipment gets flagged for inspection or there's a documentation issue, they are the ones who deal with customs officials to resolve it quickly. A delay of a few days can cost you thousands in port storage fees.

- Expertise: They know the system. They understand how to classify products correctly using the right HS code to ensure you pay the correct (and not an inflated) duty rate.

A good broker is your advocate at the border. I've seen them save clients from huge headaches and expenses. It's a non-negotiable part of my own import process.

Handling your own customs clearance is the best way to save money.Falso

While it may seem cheaper, the risk of errors, delays, fines, and storage fees from improper filing far outweighs the cost of hiring a professional customs broker. Their expertise is a form of insurance.

A good supplier should be able to provide the correct HS code for their product.Verdadeiro

A reputable and experienced manufacturer knows their products and the requirements for exporting them. They should easily provide the correct HS code, which is crucial for your customs broker to calculate duties.

How Can You Plan for Profit, Not for Surprises?

You're tired of unexpected costs eating into your profits on every project. This uncertainty makes it impossible to budget effectively. By building a buffer and using a checklist, you can plan with confidence.

Plan for profit by creating a detailed landed cost worksheet for every project. Include all four key components, confirm the HS code and Incoterms early, and add a 5-10% contingency buffer8. This proactive approach turns surprises into manageable expenses.

After years in this business, I've learned that the key to profitability isn't just finding a low price; it's about meticulous planning. You need to move from reacting to surprises to proactively planning for them.

Your Landed Cost Checklist

Before you sign any purchase order, run through this simple checklist. It will become your best defense against unexpected costs.

- Confirm the Incoterm: Is it FOB, EXW, or something else? Know exactly what you're responsible for. I almost always recommend FOB.

- Get the HS Code: Ask the supplier for the HS code and verify the duty rate for your country. Don't guess.

- Get a "Door-to-Door" Shipping Quote: Contact a freight forwarder or customs broker and ask for an all-in quote based on your order volume and Incoterm.

- Account for All Fees: Make sure your calculation includes product cost, shipping, insurance, duties, brokerage fees, and local delivery.

- Add a Contingency Buffer: I always add a 5-10% buffer to my total estimated landed cost. This covers things like currency fluctuations or a customs inspection. If you don't use it, great—it's extra profit.

This isn't about being pessimistic; it's about being a smart business professional. Planning this way allows you to price your final product with confidence, knowing your margin is protected.

A 5-10% contingency buffer is an unnecessary cost.Falso

A contingency buffer is a crucial risk management tool. It accounts for unforeseen expenses like currency shifts, customs inspections, or port delays, protecting your profit margin from surprises.

Verifying the HS code before placing an order is a key step in planning.Verdadeiro

The HS code directly determines your customs duty rate, a significant part of your landed cost. Confirming it early prevents major miscalculations and ensures your budget is accurate.

Conclusão

Calculating landed cost isn't just an accounting task; it's a strategic step. Master it, and you'll protect your profits and ensure your projects succeed from the start.

References

-

Understanding total landed cost is crucial for accurate budgeting and profitability in sourcing. ↩

-

Knowing how customs duties are calculated is essential for accurate landed cost estimations. ↩

-

Learning about Incoterms helps you understand your responsibilities and costs in international shipping. ↩

-

Understanding shipping costs can help you optimize your logistics and reduce overall expenses. ↩

-

The HS Code is vital for determining duties and ensuring compliance with customs regulations. ↩

-

Conducting a profitability analysis ensures you set the right pricing and maintain healthy margins. ↩

-

Learning about common mistakes can help you avoid pitfalls and improve your sourcing strategy. ↩

-

A contingency buffer protects your budget from unexpected costs, ensuring financial stability. ↩