As the founder of HisoAir, I’ve spent over 20 years navigating the global indoor air quality (IAQ) market. I’ve seen firsthand how rapidly developing economies can become powerhouse markets for home and industrial appliances. One of the most dynamic and promising regions today is Indonesia. With its booming middle class and rapid urbanization, the demand for lifestyle-enhancing products like humidifiers is surging.

For entrepreneurs and e-commerce brands looking to expand their product lines, understanding the key players in this market is the first step toward successful sourcing and market entry. The Indonesian humidifier landscape isn’t monolithic; it’s a fascinating tale of two distinct sectors—high-stakes industrial applications and a fast-growing consumer wellness space. This guide will break down the top 5 manufacturers and brands that define this market, providing the critical insights you need to make informed B2B purchasing decisions.

What’s Fueling Indonesia's Demand for Humidifiers?

The Indonesian household appliance market is on a remarkable growth trajectory, projected to expand at a 6.5% CAGR through 2030. This growth is powered by a burgeoning middle class with increasing disposable income and a wave of urbanization drawing millions to cities. But a unique environmental factor makes humidifiers especially relevant here: the widespread use of air conditioning.

To combat the tropical climate, HVAC systems are a necessity in Indonesian homes and businesses. This has created a massive HVAC market, expected to reach USD 7.63 billion by 2030. While essential for cooling, prolonged AC use strips moisture from the air, leading to dry skin, irritated sinuses, and other respiratory discomforts. Consumers are increasingly recognizing that humidifiers are not just a luxury but a necessary companion to their AC units to restore a healthy indoor humidity level of 40-60%.

Therefore, the growth of the Indonesian humidifier market is directly linked to strong economic growth, urbanization, and the widespread adoption of air conditioning, which creates a need to reintroduce moisture into indoor environments.

Why is the Indonesian Humidifier Market a Tale of Two Sectors?

To understand the opportunities in Indonesia, it’s crucial to recognize that the market is split into two distinct segments with different customers, products, and business models.

The Industrial/Commercial Sector: This B2B market is driven by the need for precision and process control. Here, humidity is a critical operational variable, not a matter of comfort. Industries like electronics manufacturing, pharmaceuticals, data centers, and even museums invest in high-grade humidification systems to prevent electrostatic discharge, ensure product quality, and preserve valuable assets. The key players are specialized engineering firms offering bespoke, high-performance solutions.

The Residential/Consumer Sector: This B2C market is fueled by health, wellness, and home comfort. Consumers buy portable ultrasonic humidifiers to improve sleep, alleviate allergy symptoms, and counteract the drying effects of air conditioning. This segment is dominated by international brands that have mastered digital retail and supply chain logistics.

It’s also important to note the distinction between a "manufacturer" and a "brand" in this market. While Indonesia has a growing electronics assembly industry, it is not a hub for local consumer-grade humidifier manufacturing.

Consequently, the Indonesian humidifier market is defined by global industrial manufacturers operating through local subsidiaries or distributors, and international consumer brands that succeed by importing products and dominating e-commerce channels.

Who Leads the Industrial Humidifier Sector in Indonesia?

For businesses with specialized, high-stakes humidity control needs, two names stand out in Indonesia’s industrial sector. These companies compete on technical superiority and reliability, offering solutions where failure is not an option.

1. Condair

As the world's leading manufacturer of industrial humidification systems, Switzerland-based Condair has a formidable presence in Indonesia through its exclusive distributor, PT. Vision Teknik. Condair offers a comprehensive portfolio of technologies, including advanced spray and evaporative systems, tailored for a vast range of critical applications. Their solutions are essential in sectors like automotive, pharmaceuticals, printing, data centers, and cleanrooms.

Condair positions itself as the global expert, providing high-performance, hygienic, and energy-efficient humidity control for mission-critical industrial processes.

2. PT. IKEUCHI INDONESIA

A subsidiary of the Japanese precision engineering firm IKEUCHI, this company has carved out a powerful niche with its proprietary technology. Their flagship product, the AKIMist® “E” Dry Fog Humidifier, uses pneumatic spray nozzles to create an ultra-fine mist (with droplets as small as 7.5 micrometers) that humidifies the air without wetting surfaces. This "non-wetting" feature is indispensable in sensitive environments like electronics assembly or printing, where any condensation could be catastrophic. PT. IKEUCHI INDONESIA competes on technological mastery, establishing itself as the go-to specialist for precision humidification in high-tech manufacturing.

Which Brands Dominate the Consumer Market?

The consumer segment is a different battlefield, one fought on e-commerce platforms and won through branding, features, and price. Three international brands have successfully captured the Indonesian consumer.

1. Xiaomi

This Chinese electronics giant leverages its powerful smart home ecosystem to great effect. The Xiaomi Smart Humidifier 2 is designed to integrate seamlessly with the Mi Home app, appealing to tech-savvy users. Its key selling points include a large 4.5L tank, whisper-quiet operation, and a built-in UV-C sterilization system that purifies the water before it’s turned into mist—a compelling health feature.

Xiaomi's strategy is to offer a technologically advanced, health-focused smart humidifier at a competitive mid-range price, making it an accessible entry point into their connected ecosystem.

2. Deerma

Also from China, Deerma has become a volume leader by focusing on a clear value proposition: more for less. Models like the bestselling Deerma F600 offer a large 5-liter water tank, a user-friendly touch screen, and an aromatherapy tray at a highly accessible price point. While it forgoes the smart connectivity of its rivals, its generous capacity and reliable performance have made it a favorite among first-time buyers and value-conscious consumers. Deerma's market dominance is built on providing feature-rich, large-capacity humidifiers that represent exceptional value for money.

3. Levoit

This US-based brand targets the premium wellness segment. Levoit combines sophisticated design, smart functionality via the VeSync app, and a focus on user convenience. Its flagship Classic 300S model features a massive 6-liter tank, voice assistant compatibility, and a highly praised top-fill design that makes refilling and cleaning incredibly simple. Uniquely, Levoit employs an omnichannel strategy, selling through e-commerce and physical retail stores in major Indonesian malls to reinforce its premium positioning.

Levoit has successfully positioned itself as a premium wellness brand by focusing on superior user experience, smart automation, and a multi-channel retail presence.

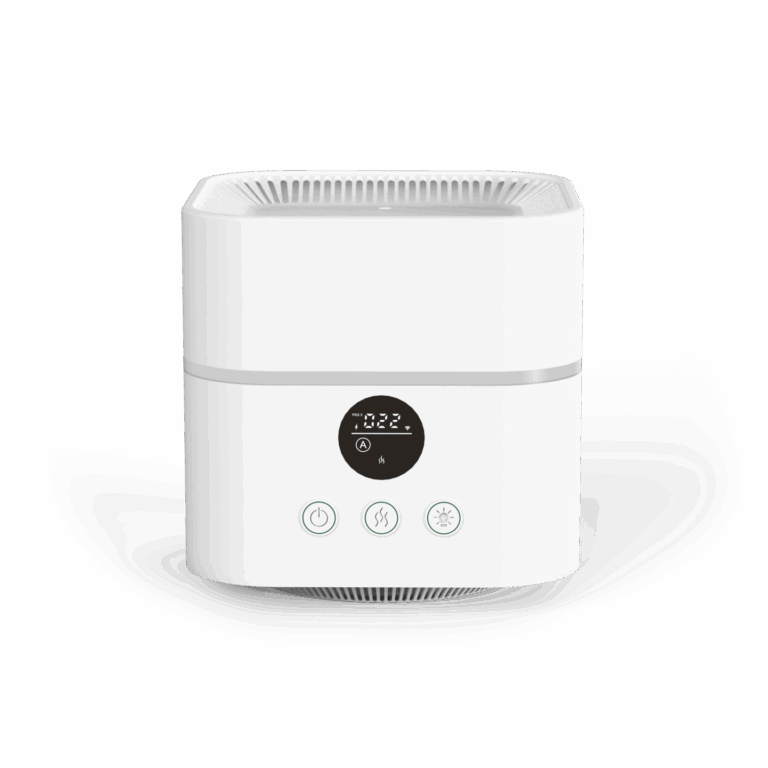

HisoAir: Global IAQ & Humidifier Manufacturer for Indonesian and Global Markets

Fonte da imagem: HisoAir

While the Indonesian market is home to strong local and international humidifier brands, global leaders like HisoAir are setting new benchmarks in performance, hygiene, and design. Headquartered in Shenzhen, China, and serving partners worldwide, HisoAir specializes in medical-grade indoor air quality (IAQ) solutions that combine ultra-quiet operation, high CADR output, and stylish form factors.

With over 50 patented designs and SGS-verified technology capable of filtering 99.8% of airborne viruses including the coronavirus family, HisoAir has built a reputation for precision manufacturing and customizable OEM/ODM partnerships. For Indonesian distributors, OEMs, and industrial buyers seeking high-performance humidifiers integrated with smart air purification technology, HisoAir offers a powerful alternative to meet growing consumer wellness demands.

How Do the Top Brands Compare?

For B2B buyers looking to source consumer products, understanding the competitive landscape is key. The industrial market is defined by specialized technology, but the consumer market is unified by ultrasonic technology, which is quiet and energy-efficient. Differentiation comes from the features built on top of that platform.

The table below offers a clear comparison of the flagship models from the top three consumer brands.

| Caraterística | Xiaomi Smart Humidifier 2 | Deerma F600 | Levoit Classic 300S |

|---|---|---|---|

| Tecnologia | Ultrassónico | Ultrassónico | Ultrassónico |

| Capacidade do depósito de água | 4.5 L | 5 L | 6 L |

| Smart Control | Yes (Mi Home App) | No (Touch screen) | Yes (VeSync App, Voice) |

| Key Differentiator | UV-C Water Sterilization | Value & Large Capacity | Top-Fill Design & App |

| Price Segment | Mid-Range | Entry-Level / Value | Prémio |

| Go-to-Market | E-commerce & Retail | E-commerce | Omnichannel (E-commerce & Retail) |

What Are the Key Opportunities for Your Business?

Analyzing Indonesia’s leading players reveals several critical trends and opportunities for brands looking to enter or expand in this market.

- Smart Home Integration is the New Standard: The success of Xiaomi and Levoit proves that IoT connectivity is no longer a niche feature. Consumers expect the convenience of app control and automation, especially in mid-to-premium appliances.

- Health and Hygiene Features Sell: In a crowded market, tangible health benefits are a powerful differentiator. Xiaomi’s UV-C sterilization is a perfect example. Features that ensure clean, pathogen-free mist will command consumer attention.

- Convenience Commands a Premium: Levoit’s success with its top-fill design shows that consumers will pay more for products that solve common frustrations like difficult cleaning and refilling.

- A Market Gap Exists: Notably, many major global appliance brands like Samsung, Sharp, and Panasonic are active in Indonesia’s air purifier market but have a minimal presence in the humidifier category. This creates a significant opportunity for a trusted OEM/ODM partner like HisoAir to help new or established brands enter the market and capture share with high-quality, customized products.

Conclusion: Sourcing for Success in a High-Growth Market

The Indonesian humidifier market offers tremendous potential, but success requires a clear strategy. The landscape is sharply divided between the high-tech industrial sector and the fast-paced, digitally-driven consumer sector. The leaders—Condair, IKEUCHI, Xiaomi, Deerma, and Levoit—have each mastered their respective domains through technological specialization, smart branding, or strategic value positioning.

For B2B buyers and brands, the path forward is clear: adopt a digital-first strategy, differentiate with health and convenience features, and choose a clear position between smart-tech and high-value. As an experienced OEM/ODM manufacturer with facilities across Asia, we at HisoAir are perfectly positioned to help you navigate this landscape. We provide the design expertise, manufacturing excellence, and quality control needed to build a standout product line for this booming market.

Let’s connect and explore how we can elevate air quality together.