Worried about tariffs and a fragile supply chain? You're looking at Thailand for manufacturing, but finding the right partner feels like searching for a needle in a haystack.

While Thailand has strong manufacturers in sectors like automotive and air conditioning, a definitive "top 10" list for innovative humidifiers is misleading. The key players are often large OEMs producing for global brands, not agile partners for new D2C product development.

You probably landed here searching for a list of factories. I get it. As someone who has spent his life in mold making and manufacturing, I know the pressure to find reliable partners. You're trying to protect your business by diversifying away from China. But a simple list of names won't solve your problem. In fact, it might create a bigger one. Before you book a flight to Bangkok, let's talk about the reality on the ground. I want to walk you through what Thailand can—and can't—do for a brand like yours. This will help you make a much smarter decision.

Thailand is the second-largest economy in Southeast Asia and a major exporter of electronics and automotive parts.Правда

According to the World Bank and multiple trade reports, Thailand's economy is heavily reliant on exports, with automotive and electronics being two of its most critical sectors.

Thailand is the world's number one manufacturer of small home appliances like humidifiers.Ложь

China remains the dominant global manufacturer for small home appliances by a significant margin, possessing a vast and highly integrated supply chain for these specific products.

1. Introduction: Why Are D2C Brands Now Looking at Thailand?

Feeling the pressure from trade tensions and supply chain headaches? You're not alone. Many brands are scrambling for a "China Plus One" strategy, and Thailand seems like a perfect solution.

D2C brands are exploring Thailand to diversify their supply chains, reduce potential tariff impacts, and secure new manufacturing partners. Its established infrastructure, government incentives, and strategic location in Southeast Asia make it an attractive alternative for companies looking to reduce their reliance on China.

The "China Plus One" Rush

I've seen this trend firsthand. Every time there's a new tariff announcement or a major port lockdown, my phone rings. Clients who were once comfortable with their Chinese suppliers suddenly want to know about Vietnam, Mexico, or India. Right now, Thailand is the hot topic. On the surface, it makes perfect sense. It's a stable country with a good reputation for manufacturing quality in certain industries.

For a product designer like Jacky, the goal is to de-risk the supply chain for his company. Moving some production to Thailand seems like a logical step to avoid having all his eggs in one basket. The thinking is that a factory in Thailand protects the business from geopolitical issues between the US and China. But this only looks at one type of risk.

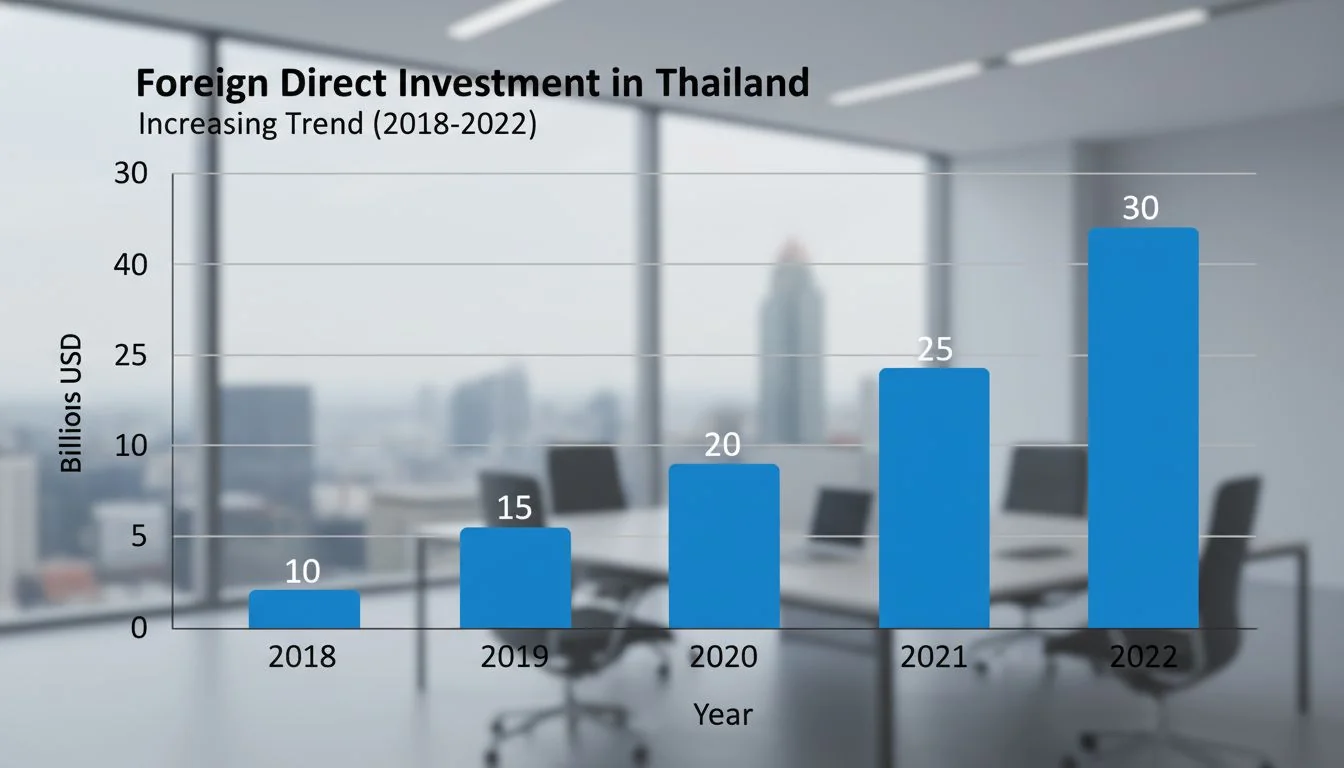

The 'China Plus One' strategy has led to a significant increase in foreign direct investment (FDI) into Thailand over the past five years.Правда

Data from the Thailand Board of Investment (BOI) shows a consistent rise in FDI applications, particularly in the electronics, automotive, and medical sectors, as companies diversify their manufacturing bases.

Moving production to Thailand completely eliminates supply chain risks.Ложь

While it mitigates risks related to specific tariffs, it introduces new challenges, such as a less-developed component ecosystem, which can lead to its own set of delays and dependencies, often still relying on Chinese parts.

2. Thailand's Manufacturing Landscape: A Reality Check (Pros vs. Cons)?

Thailand looks great on paper, a manufacturing powerhouse in Southeast Asia. But what's the reality on the ground when you need to make a small, innovative appliance like a humidifier?

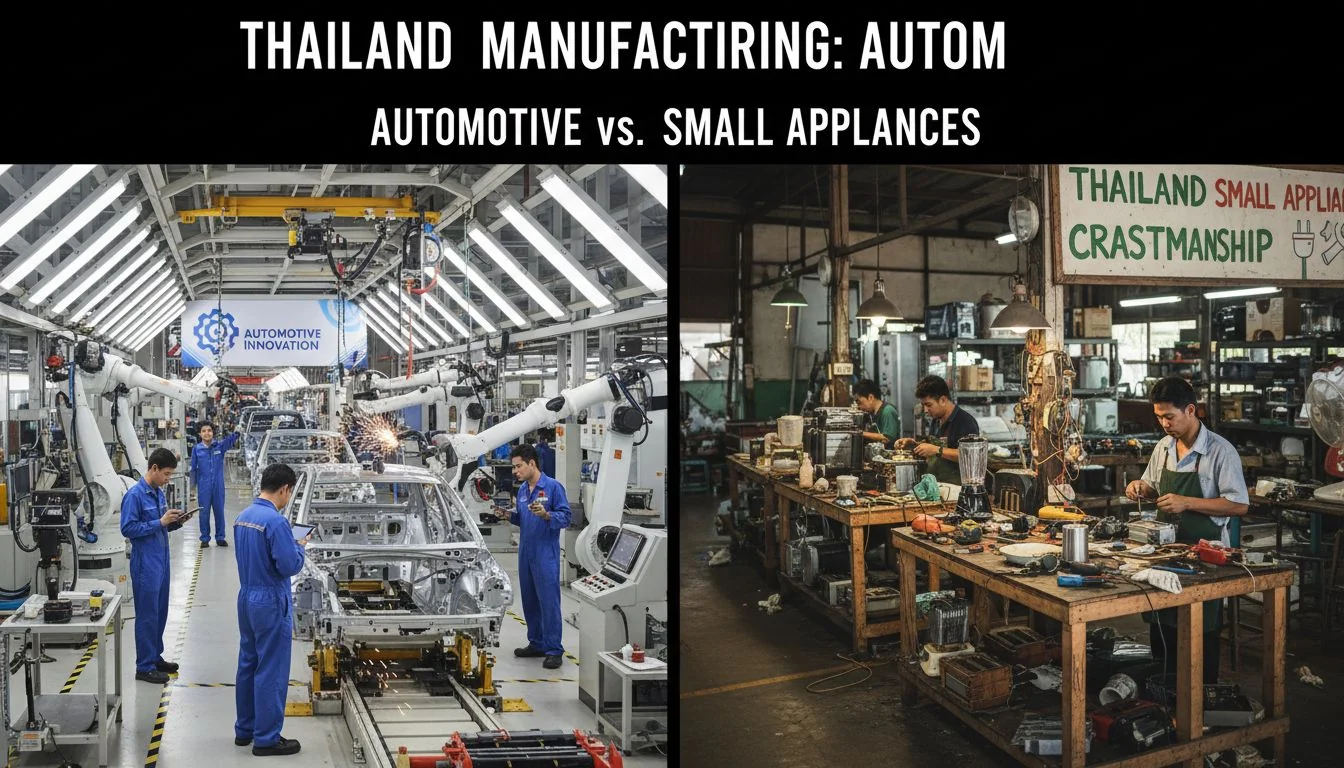

Thailand excels in automotive and air conditioning manufacturing, boasting a skilled workforce and robust infrastructure in these sectors. However, its ecosystem for small, innovative consumer electronics and appliances is far less developed, especially when compared to the hyper-focused environment of Shenzhen.

Strengths and Weaknesses for Your Product

When I started my own trading company, I learned quickly that a country's manufacturing strength is never uniform. A place that's brilliant for building cars might be a terrible choice for making smartwatches. You have to look at the specific ecosystem for your product. For a product designer like Jacky, this means understanding the local supply chain for plastics, electronics, and specialized components. Here’s an honest breakdown for Thailand:

| Pros (The Strengths) | Cons (The Gaps) |

|---|---|

| Strong Infrastructure: World-class ports and logistics. | Weak R&D for Small Appliances: Few partners for true innovation. |

| Skilled Labor (in specific sectors): Deep expertise in auto and A/C. | Component Dependency: Many electronic parts are still imported from China. |

| Government Incentives: The Board of Investment (BOI) offers tax breaks. | Slower Development Cycles: Tooling and prototyping for new designs take longer. |

| ASEAN Trade Benefits: Duty-free access to other Southeast Asian markets. | Higher "Total Cost" for Innovation: Lower labor costs can be offset by delays and sourcing issues. |

The key takeaway is that Thailand is set up for large-scale, established production lines. It's not built for the fast, iterative, and innovative development that D2C brands need to stand out.

Thailand is a global top 10 producer of automobiles.Правда

The Thai Automotive Industry Association and international reports confirm Thailand's position as a major automotive production and export hub, often referred to as the 'Detroit of Asia.'

You can easily source all high-tech electronic components for a smart humidifier from local Thai suppliers.Ложь

While basic components are available, the ecosystem for specialized microcontrollers, custom PCBs, and advanced sensors is not as mature as in China or Taiwan. Most of these are imported.

3. Key Players: Who Is Actually Manufacturing in Thailand?

You came here for a list of humidifier manufacturers, right? The truth is, the names you'll find are probably not the partners you're looking for. It's a different kind of game there.

The primary humidifier manufacturers in Thailand are often large, established OEMs (Original Equipment Manufacturers). They produce for major global brands like Panasonic or Sharp and are set up for high-volume, low-variation production runs, not for agile D2C product development and innovation.

OEM Giants vs. D2C Partners

So, why won't I just give you a "Top 10" list? Because it would be a disservice to you. I could list companies that are technically capable of injection molding and assembly. But these are giant operations. Their business model is built around serving billion-dollar corporations.

Here’s what that means for a D2C brand or a designer like Jacky:

- High MOQs: They expect orders in the tens or hundreds of thousands of units, not the few thousand you might need for a new product launch.

- Limited Flexibility: Their processes are rigid. They are not set up to work with you on rapid prototyping, design changes, or material experiments. They want a finalized, production-ready design.

- No R&D Collaboration: They are executors, not innovation partners. They will build what you tell them to, but they won't help you solve complex design challenges or pioneer a new feature.

You're not looking for an assembler. You're looking for a partner who can help you bring a unique vision to life. Those partners are incredibly rare in Thailand for this specific product category.

Many major Japanese electronics brands have large-scale manufacturing facilities in Thailand.Правда

Companies like Panasonic, Sony, and Mitsubishi have had a significant manufacturing presence in Thailand for decades, primarily focusing on air conditioners, refrigerators, and automotive electronics.

These large OEMs in Thailand are actively seeking to partner with small D2C startups.Ложь

The business models of large OEMs are based on volume and efficiency, which are often incompatible with the smaller orders, higher customization, and faster iteration cycles required by D2C brands.

4. The "Innovation Gap": What You Won't Easily Find in Thailand?

You have a unique product idea, something that will stand out from the sea of cheap plastic humidifiers. But can you actually get it made in Thailand? The answer might frustrate you.

Thailand's manufacturing ecosystem currently has an "innovation gap" in small home appliances. You will struggle to find partners with deep R&D capabilities for niche materials, advanced electronics, or unique product features—like the stainless steel humidifier we developed at Hisoair.

The Real Risk: Product Mediocrity

Everyone is worried about tariff risk. But I believe the much bigger danger is "product innovation risk." Launching another generic, "me-too" plastic humidifier from a Thai factory is riskier than launching a truly unique product from an expert partner, regardless of location.

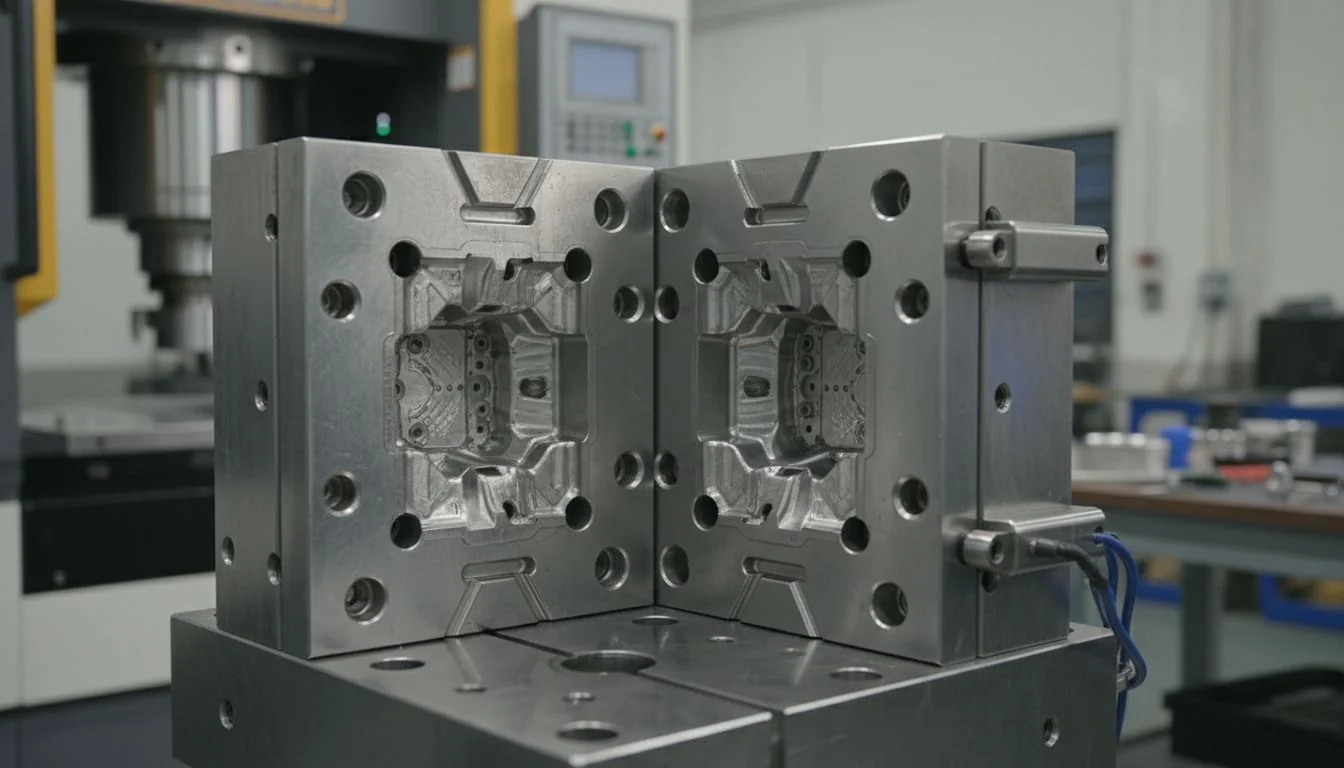

Think about what it takes to create something genuinely new. Let's use our stainless steel humidifier as an example. To make it, we had to:

- Master New Materials: Source and test food-grade 304 stainless steel for anti-bacterial properties and durability.

- Develop Complex Tooling: Engineer deep-drawing molds, a process completely different from plastic injection.

- Integrate Custom Electronics: Design a PCB that could handle the unique power and sensor requirements.

Trying to coordinate this from scratch in Thailand would be a nightmare. You'd be managing a dozen different suppliers, none of whom have done this before. The "total cost"—factoring in delays, mistakes, and travel—would be enormous. This is the innovation gap.

Thailand has a mature ecosystem for advanced tooling for deep-drawing stainless steel for small appliances.Ложь

While metal stamping for the auto industry is strong, the specialized tooling and expertise for deep-drawing complex consumer product shapes from stainless steel is a niche capability not widely available.

Product differentiation is more critical for D2C brand success than marginal savings on manufacturing location.Правда

Market studies consistently show that D2C brands thrive on unique value propositions, superior design, and brand storytelling. A 'me-too' product, even if cheaper to produce, struggles to gain traction and command premium pricing.

5. A Smarter Supply Chain: "China R&D Hub + Flexible Assembly"?

What if you could get the best of both worlds? The unmatched innovation engine of one region with the logistical flexibility of another? There is a smarter way to build your supply chain.

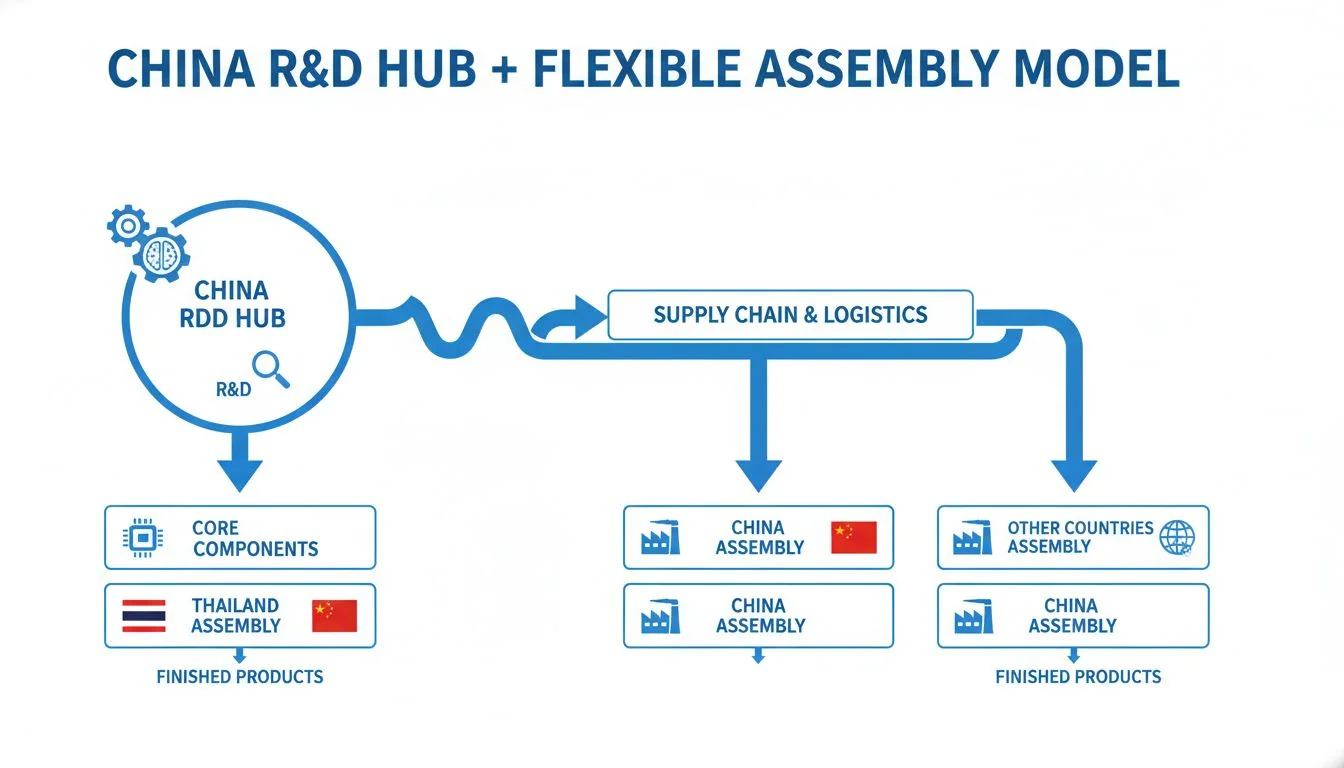

A modern, resilient supply chain model uses a specialized R&D hub, like those in the Pearl River Delta, for complex design, tooling, and engineering. Then, you can use flexible assembly locations—which could include Thailand, Vietnam, or even a different part of China—for final production.

Separate Innovation from Assembly

For years, we've been taught to think of "Made in China" or "Made in Thailand" as a single, all-or-nothing choice. That's old thinking. The most successful brands I work with today are much more strategic. They unbundle the supply chain.

Here's how the model works:

- Step 1: Centralize R&D: You partner with a hub of innovation, a place with a dense network of engineers, material scientists, and tooling experts. This is where you solve the hard problems and create your "secret sauce."

- Step 2: Develop Core Components: Your R&D partner produces the most critical and complex parts—the custom-molded housing, the proprietary electronics, the innovative mechanism.

- Step 3: Flexible Final Assembly: These core components are then shipped to a final assembly location. This location can be chosen based on labor costs, logistics, or tariff advantages.

This approach gives you the ultimate advantage: you get world-class innovation without being tied to a single manufacturing country. You're no longer choosing between China and Thailand; you're using the strengths of both.

Shenzhen's R&D ecosystem allows for rapid prototyping of electronics in days, not months.Правда

Shenzhen is famous for its 'speed to market,' with a highly concentrated and competitive ecosystem of PCB manufacturers, component markets, and firmware engineers that can turn around prototypes at an unparalleled pace.

The 'R&D Hub + Flexible Assembly' model is more expensive than traditional single-country manufacturing.Ложь

While it may seem more complex, this model often reduces 'total cost' by minimizing expensive R&D delays, ensuring higher product quality, and allowing for faster speed-to-market, which generates revenue sooner.

6. Why Your Partner Is More Important Than Your Location (Hisoair's Solution)?

You've been focused on where to manufacture. But the most critical question is who you will manufacture with. This is the single most important decision you will make for your product.

The right manufacturing partner de-risks your entire project. A partner with proven R&D capabilities, like Hisoair, can deliver an innovative product faster and more reliably. This value is far greater than simply finding a factory in a low-tariff country.

We Are an R&D Hub First, a Factory Second

I built my career from a factory floor to running my own company by solving my clients' hardest problems. I wasn't just a supplier; I was the person they called when a design seemed impossible. That is the entire philosophy behind Hisoair.

Anyone can assemble a product. Only a few can truly innovate.

Our stainless steel humidifier is our proof. We didn't just find a factory to make it. We invented it. We are the R&D hub. We solved the material, tooling, and electronic challenges that others couldn't. That is the value we offer.

For a designer like Jacky, working with us means:

- De-risked Innovation: We take on the technical risk, so you can focus on your brand and customers.

- Скорость выхода на рынок: Our integrated R&D and manufacturing process is dramatically faster than trying to coordinate multiple suppliers in a new country.

- A True Partner: We work with you from concept to completion. Your success is our success.

Stop chasing a location on a map. The geography of your factory is less important than the capability of your partner.

Заключение

Stop chasing locations and start searching for an innovation partner. The right partner makes your location irrelevant and ensures your product is a success, de-risking your launch and securing your brand's future.