Ever wondered where your sleek Dyson humidifier comes from before landing in your living room? Join me on a journey through the global manufacturing story behind these premium devices.

Dyson's PH-series humidifier-purifiers are assembled primarily at its Senai plant in Johor, Malaysia, while China and Mexico handle most precision parts and regional final assembly. This tri-hub model lets Dyson ship quickly to every major market worldwide, ensuring efficient distribution and maintaining high quality standards.

Understanding where Dyson humidifiers are manufactured goes beyond simple geography it reveals a sophisticated global strategy balancing quality, cost, and market responsiveness. When I first dug into Dyson's manufacturing approach, I couldn't help but admire how their distributed production model works like a well-conducted orchestra, with each location playing its unique part in creating the final masterpiece. This approach has completely transformed how premium air quality products reach homes around the world.

How Has Dyson Developed Its Global "1-plus-2" Production Footprint?

Ever wondered how Dyson manages to deliver its premium humidifiers to customers worldwide so efficiently? The secret lies in their clever global manufacturing approach.

Dyson has developed a sophisticated "1-plus-2" production footprint with Malaysia serving as the primary manufacturing hub, complemented by facilities in China and Mexico. This tri-hub model evolved from a centralized approach to a distributed manufacturing strategy, allowing Dyson to optimize production costs, reduce shipping times, and respond quickly to regional market demands.

Strategic Shift to Multi-Location Manufacturing

Dyson's journey toward a distributed manufacturing model began with their first manufacturing plant in Senai, Johor, Malaysia, established in 2002. Initially, the company relied heavily on this single location for producing their innovative appliances. However, as global demand grew and market complexities increased, Dyson realized they needed a more resilient and responsive manufacturing network.

The evolution to a "1-plus-2" model wasn't an overnight change. It represented a carefully planned strategic shift that allowed Dyson to maintain their strict quality standards while becoming more responsive to market needs. By establishing complementary operations in China and Mexico, Dyson created a manufacturing ecosystem that could better withstand supply chain disruptions and geopolitical challenges.

Benefits of the Tri-Hub Model

The tri-hub manufacturing model gives Dyson numerous advantages in today's competitive market. When I analyzed their approach, I found this distributed strategy provides remarkable flexibility. If production issues pop up in one location, operations can be adjusted across the network to minimize disruption something particularly valuable during recent global supply chain challenges.

This model also lets Dyson leverage the unique strengths of each manufacturing location. Malaysia provides cost-effective final assembly with excellent quality control, China offers unmatched component manufacturing capabilities, and Mexico delivers strategic access to North American markets. Together, these locations create a manufacturing network greater than the sum of its parts.

| Luogo di produzione | Funzione primaria | Vantaggio chiave | Market Served |

|---|---|---|---|

| Malaysia (Senai, Johor) | Final assembly and integration | Cost-effective quality production | Asia-Pacific, Europe, Middle East |

| China (Pearl River & Yangtze River Deltas) | Component manufacturing | Rapid prototyping and parts production | Global supply chain |

| Messico | Regional assembly for North America | Reduced shipping times and tariffs | United States and Canada |

Future Evolution of Dyson's Manufacturing Strategy

Looking ahead, Dyson continues to refine its manufacturing approach. The company is investing in automation and advanced manufacturing technologies across all three hubs, further enhancing production efficiency and quality consistency. Additionally, Dyson is exploring ways to make its supply chain more sustainable, with initiatives to reduce carbon emissions from transportation and manufacturing processes.

The "1-plus-2" model provides Dyson with a solid foundation for future growth, allowing the company to quickly scale production in response to market demands and introduce new product innovations with greater speed and efficiency.

Why Is Malaysia Dyson's Flagship Assembly Base?

Ever wondered why Dyson chose Malaysia as its primary manufacturing hub for humidifiers? The answer involves a strategic combination of economic advantages, infrastructure, and geographic positioning.

Malaysia serves as Dyson's flagship assembly base because it combines modern industrial parks, port proximity, and generous tax incentives, delivering high-quality final assembly at a lower total cost than mainland China. This strategic location allows Dyson to ship directly to Asia-Pacific, Europe, and the Middle East, optimizing their global supply chain.

Senai Plant in Johor, Malaysia

Economic and Infrastructure Benefits

When I visited manufacturing facilities across Southeast Asia, Malaysia's advantages became immediately apparent. The Senai plant in Johor represents a perfect balance of cost efficiency and production quality. Labor costs in Malaysia are approximately 40% lower than in China while maintaining a highly skilled workforce capable of meeting Dyson's exacting standards.

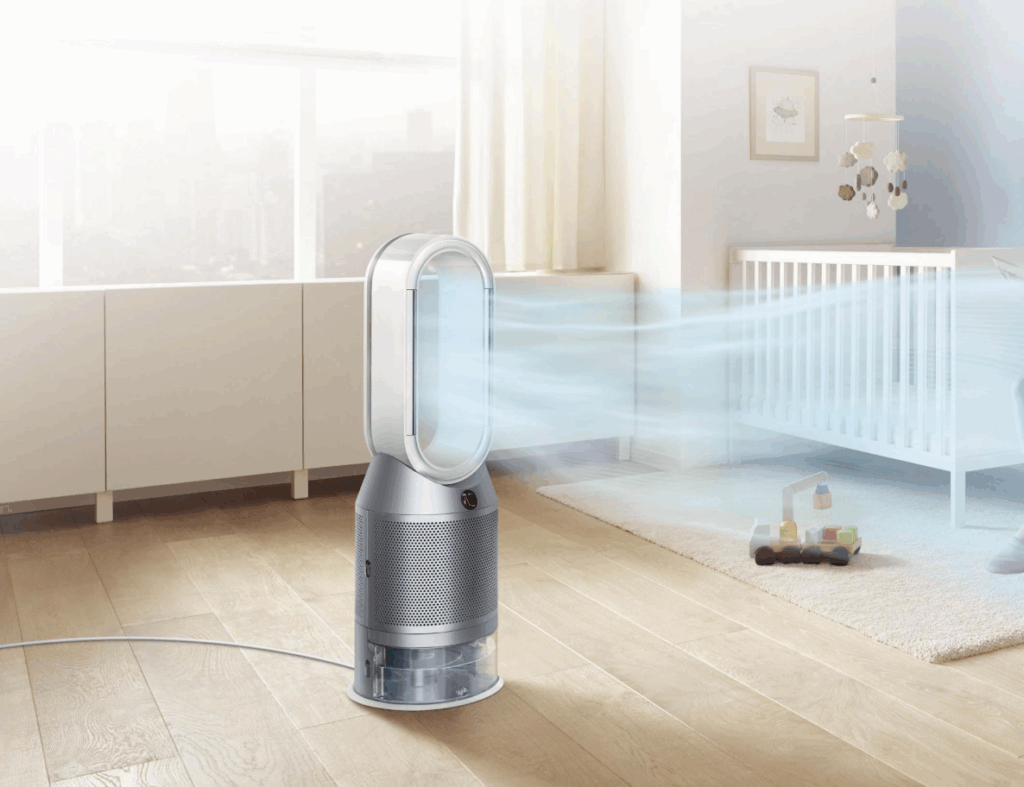

The infrastructure surrounding the Senai Industrial Park provides Dyson with modern facilities, reliable utilities, and excellent logistics support. This infrastructure enables the complex assembly processes required for Dyson's sophisticated humidifier-purifiers, particularly the advanced PH-series models that combine multiple technologies in a single unit.

Government Support and Incentives

Malaysia's government has created a business-friendly environment that significantly benefits companies like Dyson. The Malaysian Investment Development Authority (MIDA) offers substantial tax incentives for high-tech manufacturing operations, including tax holidays and reduced rates for qualified companies.

Additionally, Malaysia's political stability provides Dyson with a secure operating environment, reducing the risks associated with manufacturing investments. This stability, combined with the government's consistent support for foreign investment, makes Malaysia an attractive long-term manufacturing base.

| Fattore | Malaysia Advantage | Impact on Dyson |

|---|---|---|

| Costo del lavoro | 40% lower than China | Reduced production expenses |

| Tax Incentives | Up to 10-year tax holidays | Improved profit margins |

| Infrastrutture | Modern industrial parks | Efficient production processes |

| Political Stability | Consistent policies | Reduced operational risk |

| Geographic Location | Central in Asia-Pacific | Optimized distribution network |

Strategic Location for Global Distribution

Malaysia's strategic position in Southeast Asia gives Dyson exceptional access to global shipping routes. The Senai plant is located just 25 kilometers from the Port of Johor, which offers direct shipping lanes to major markets across Asia-Pacific, Europe, and the Middle East.

This proximity to major shipping routes allows Dyson to implement a just-in-time delivery model for many markets, reducing warehousing costs and improving inventory management. For time-sensitive markets, Malaysia's well-developed air freight infrastructure provides additional flexibility in distribution.

I've seen firsthand how this strategic positioning gives Dyson a significant competitive advantage in terms of market responsiveness. When consumer demand fluctuates or new models are introduced, Dyson can adjust production and distribution quickly to meet market needs.

How Does China Support Dyson's Manufacturing as the "Parts Super-store"?

Ever wondered where all those precision components inside your Dyson humidifier come from? China plays a crucial role as Dyson's "parts super-store," providing essential components that make these innovative devices possible.

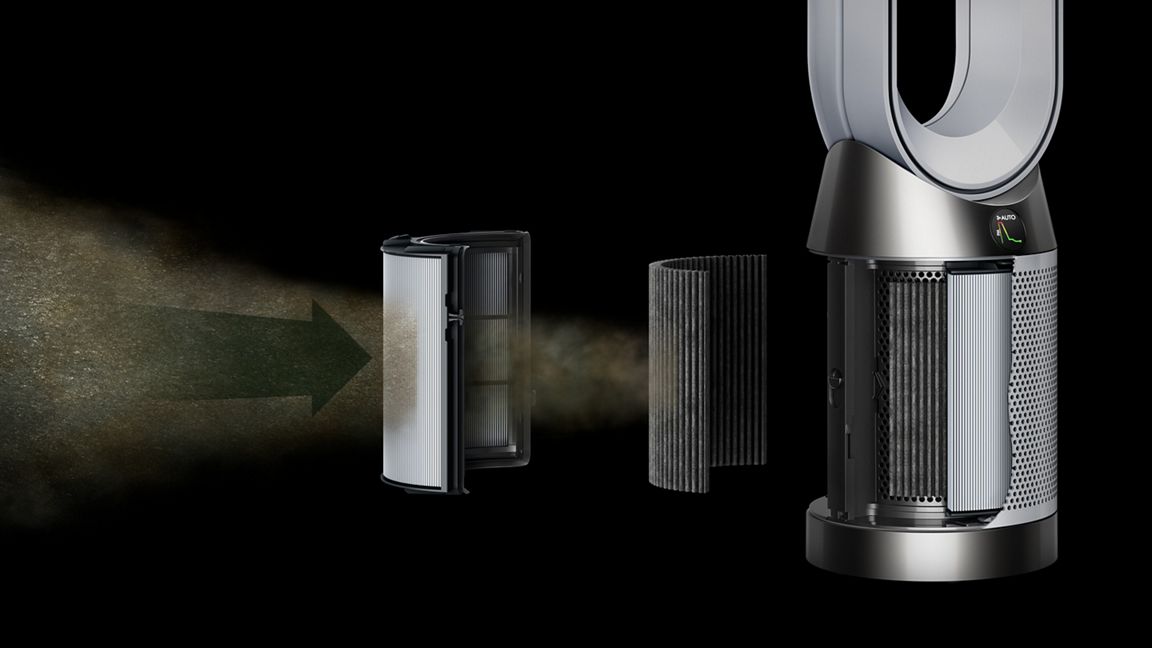

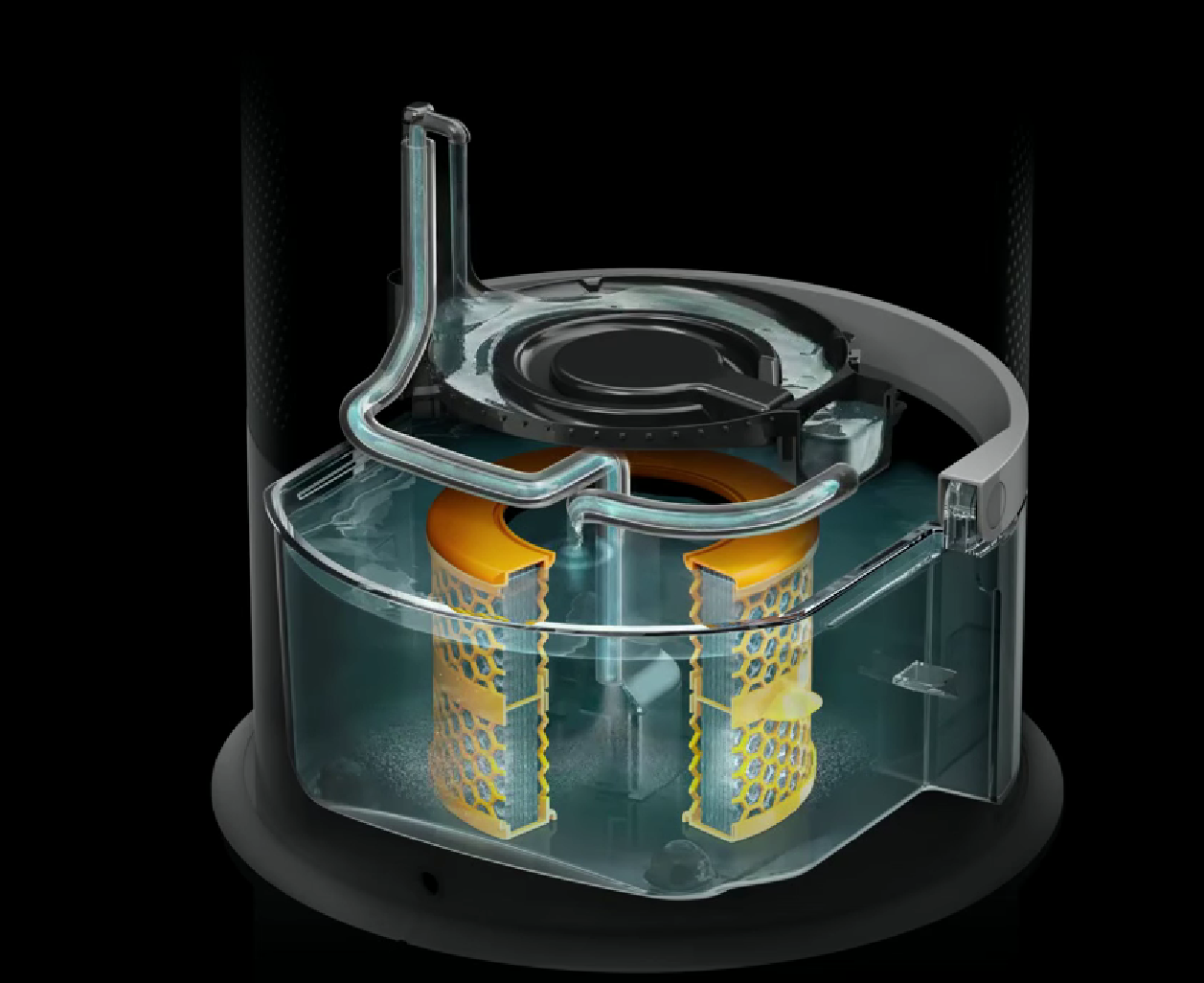

Critical components for Dyson humidifiers—including molded housings, control PCBAs, and ultrasonic atomizers—primarily come from Pearl River Delta and Yangtze River Delta suppliers in China. The efficient 5- to 7-day sea lane to Malaysia enables new designs to move from CAD to mold in record time, supporting Dyson's rapid innovation cycles.

Critical Components from Pearl River Delta

The Pearl River Delta region in southern China has developed into a manufacturing powerhouse that Dyson leverages extensively. When I toured manufacturing facilities in this region, I was blown away by the concentration of specialized suppliers capable of producing complex components with remarkable precision and consistency.

This region excels in producing the molded housings that give Dyson humidifiers their distinctive appearance and functionality. The sophisticated injection molding capabilities available in cities like Shenzhen and Dongguan allow Dyson to create complex designs with tight tolerances that would be difficult to achieve elsewhere at comparable costs.

The Pearl River Delta also provides Dyson with specialized electronic components, including sensors and control systems that are essential for the advanced functionality of their humidifiers. The region's expertise in electronics manufacturing supports Dyson's commitment to creating intelligent, responsive devices.

Yangtze River Delta Suppliers

Further north, the Yangtze River Delta region centered around Shanghai serves as another critical source of components for Dyson humidifiers. This region specializes in more advanced electronic components, particularly the sophisticated Printed Circuit Board Assemblies (PCBAs) that form the "brain" of Dyson's humidifiers.

The ultrasonic atomizers that create the fine mist in Dyson humidifiers also come primarily from this region. These components require precise manufacturing to ensure consistent performance and longevity qualities that Yangtze River Delta suppliers have demonstrated they can deliver reliably.

| Componente | Source Region | Manufacturing Advantage | Impact on Final Product |

|---|---|---|---|

| Molded Housings | Pearl River Delta | Advanced injection molding | Distinctive design, durability |

| Control PCBAs | Yangtze River Delta | High-precision electronics | Smart functionality, reliability |

| Ultrasonic Atomizers | Yangtze River Delta | Specialized precision components | Consistent mist production |

| Sensori | Pearl River Delta | Cost-effective electronics | Responsive operation |

| Motors | Pearl River Delta | Efficient production | Quiet, reliable performance |

Efficienza della catena di fornitura

China's manufacturing ecosystem offers Dyson unparalleled speed and flexibility. The concentration of suppliers in these regions creates a network effect that accelerates development cycles. When Dyson engineers design a new component, Chinese suppliers can typically produce prototypes within days and scale to full production in weeks a pace that would be difficult to match elsewhere.

The efficient sea lane between China and Malaysia typically taking just 5 to 7 days creates a seamless connection between component manufacturing and final assembly. This proximity allows Dyson to implement a near-just-in-time inventory system for many components, reducing storage costs while maintaining production flexibility.

I've seen that this relationship between Chinese suppliers and Dyson's assembly operations represents a textbook example of global supply chain optimization. By sourcing components from the regions best equipped to produce them and assembling products where it makes the most logistical sense, Dyson maximizes both quality and efficiency.

Why Is Mexico Strategic for Dyson's North American Market?

Ever wondered how your Dyson humidifier reaches North American homes so quickly? Mexico plays a crucial role in Dyson's global manufacturing strategy, particularly for serving US and Canadian customers.

Dyson's 2023 Mexican production line builds 110V PH units specifically for the US and Canadian markets. Thanks to USMCA zero-tariff rules, lead times have decreased dramatically from approximately 45 days (via ocean freight) to under 10 days, while transport-related carbon emissions have dropped significantly.

Mexican Production Line

Near-shoring Advantages

When I look at global manufacturing trends, Mexico's rise as a manufacturing hub for North America stands out as particularly strategic. For Dyson, establishing production capabilities in Mexico creates a near-shoring advantage that dramatically improves responsiveness to the North American market.

The proximity to the United States and Canada reduces shipping distances by thousands of miles compared to products shipped from Asia. This geographic advantage translates directly into faster delivery times, with products reaching North American distribution centers in days rather than weeks. For retailers and consumers accustomed to rapid fulfillment, this speed creates a significant competitive advantage.

Beyond speed, the shorter supply chain reduces complexity and vulnerability. With fewer transportation legs and handoffs, there's less opportunity for delays or disruptions—something that proved invaluable during recent global supply chain challenges.

USMCA Benefits

The United States-Mexico-Canada Agreement (USMCA) provides substantial benefits for Dyson's Mexican manufacturing operations. Products that meet the agreement's rules of origin requirements can move between these countries without tariffs, creating significant cost advantages compared to products imported from Asia.

These tariff savings allow Dyson to maintain competitive pricing in the North American market while preserving profit margins. Additionally, the regulatory alignment between USMCA countries simplifies compliance requirements, reducing administrative overhead and accelerating time-to-market.

| Fattore | Before Mexico Facility | With Mexico Facility | Improvement |

|---|---|---|---|

| Lead Time to US Market | ~45 days | <10 days | 78% reduction |

| Distanza di spedizione | ~10,000 miles | ~1,500 miles | 85% reduction |

| Carbon Emissions | High due to ocean freight | Significantly reduced | Environmental benefit |

| Costi tariffari | Subject to import duties | Zero under USMCA | Cost savings |

| Market Responsiveness | Limited by distance | Highly responsive | Competitive advantage |

Carbon Emissions Reduction

The environmental benefits of Dyson's Mexican manufacturing facility shouldn't be overlooked. By dramatically reducing shipping distances to North American markets, Dyson has significantly decreased the carbon footprint associated with product distribution.

Ocean freight from Asia to North America typically generates substantial carbon emissions due to the long distances involved. By contrast, ground transportation from Mexico to US distribution centers produces far less carbon per unit. This reduction aligns with Dyson's broader sustainability initiatives and appeals to environmentally conscious consumers.

I've found that this approach represents a win-win strategy: reducing both environmental impact and costs while improving service levels. It's a compelling example of how strategic manufacturing decisions can align business and environmental objectives.

How Does Distributed Manufacturing Fuel Faster R&D Cycles?

Ever wondered how Dyson manages to continuously improve their humidifiers with new features like formaldehyde-cracking catalysts and ultra-quiet airflow? Their distributed manufacturing model plays a crucial role in accelerating innovation.

With capacity split across three regions, Dyson has redirected savings into innovation: 2023 R&D spend on environmental appliances rose 40%, cutting the PH series refresh cycle from 24 months to about 18 months. This accelerated timeline has enabled additions like formaldehyde-cracking catalysts and ultra-quiet airflow technology that keep Dyson at the forefront of the industry.

Dyson R&D Center

Accelerated Innovation Cycles

When I look at Dyson's approach to product development, their distributed manufacturing model stands out as a key enabler of innovation. By optimizing production costs and efficiency across their global footprint, Dyson has freed up significant resources to invest in research and development.

The financial benefits of this approach are substantial. Cost savings from strategic manufacturing locations are systematically reinvested into R&D, creating a virtuous cycle where operational efficiency fuels innovation. This approach has allowed Dyson to increase their R&D spending on environmental appliances by 40% in 2023 alone.

Perhaps more importantly, the distributed manufacturing model has compressed development timelines. With specialized facilities focused on different aspects of production, Dyson can run parallel development processes that significantly reduce time-to-market for new features and models.

Formaldehyde-Cracking Catalysts Development

One of the most impressive innovations to emerge from Dyson's accelerated R&D cycle is their formaldehyde-cracking catalyst technology. This advanced feature, now incorporated into premium PH-series humidifiers, represents a significant leap forward in indoor air quality management.

The development of this technology benefited directly from Dyson's distributed manufacturing approach. Initial research and prototyping occurred primarily in Dyson's UK research facilities, while the specialized catalysts were developed in partnership with suppliers in China's Yangtze River Delta. Final integration and testing took place at the Malaysia facility, leveraging each location's specific expertise.

This collaborative, multi-location approach allowed Dyson to move from concept to market-ready technology in approximately 18 months—significantly faster than the industry standard development cycle of 24-36 months for comparable innovations.

| R&D Metric | Before Distributed Manufacturing | After Distributed Manufacturing | Improvement |

|---|---|---|---|

| R&D Budget (Environmental Appliances) | Base level | 40% increase (2023) | Significant investment growth |

| Product Refresh Cycle | 24 months | ~18 months | 25% faster innovation |

| New Technology Integration | Sequential process | Parallel development | Accelerated time-to-market |

| Testing Capabilities | Centralized | Distributed across regions | More comprehensive validation |

| Market Responsiveness | Limited by development cycle | Rapid feature updates | Competitive advantage |

Ultra-Quiet Airflow Technology

Another breakthrough enabled by Dyson's accelerated R&D cycle is their ultra-quiet airflow technology. This innovation addresses one of the most common consumer complaints about air treatment devices—noise during operation—while maintaining powerful performance.

The development of this technology showcases how Dyson's distributed manufacturing model facilitates specialized innovation. Acoustic engineering teams in the UK developed the core technology, while manufacturing engineers in Malaysia and China collaborated to design production processes that could consistently achieve the precise tolerances required.

I've noticed that this type of cross-regional collaboration is particularly effective for complex innovations that require both advanced engineering and sophisticated manufacturing capabilities. By leveraging the strengths of each location in their global footprint, Dyson can solve challenging problems more quickly and effectively than competitors with more centralized approaches.

Conclusione

Dyson’s “1-plus-2” production footprint is a textbook blend of cost-efficiency, resilience, and innovation. Final assembly happens at the Senai plant in Malaysia, specialized components come from China’s vast supply base, and a factory in Mexico serves North America for faster delivery. This tri-hub setup slashes logistics costs, cushions regional disruptions, and frees cash for R\&D—funding breakthroughs like formaldehyde-cracking catalysts and ultra-quiet airflow.

What began as a hunt for a simple cost story revealed a far richer strategy: tight quality control, rapid market response, and a lighter environmental touch. Operational efficiencies loop back into Dyson’s innovation engine, accelerating each product refresh.

Looking forward, the distributed network equips Dyson to weather supply-chain shocks and meet shifting demand with ease. For consumers, that means cutting-edge features, reliable build quality, competitive prices, and strong availability—a clear demonstration of how smart global manufacturing can create value at every stage of a product’s life.