Remember the empty shelves and shipping delays? Your brand felt the pain of relying on one source. The China+1 strategy offers a path to resilience and stable growth.

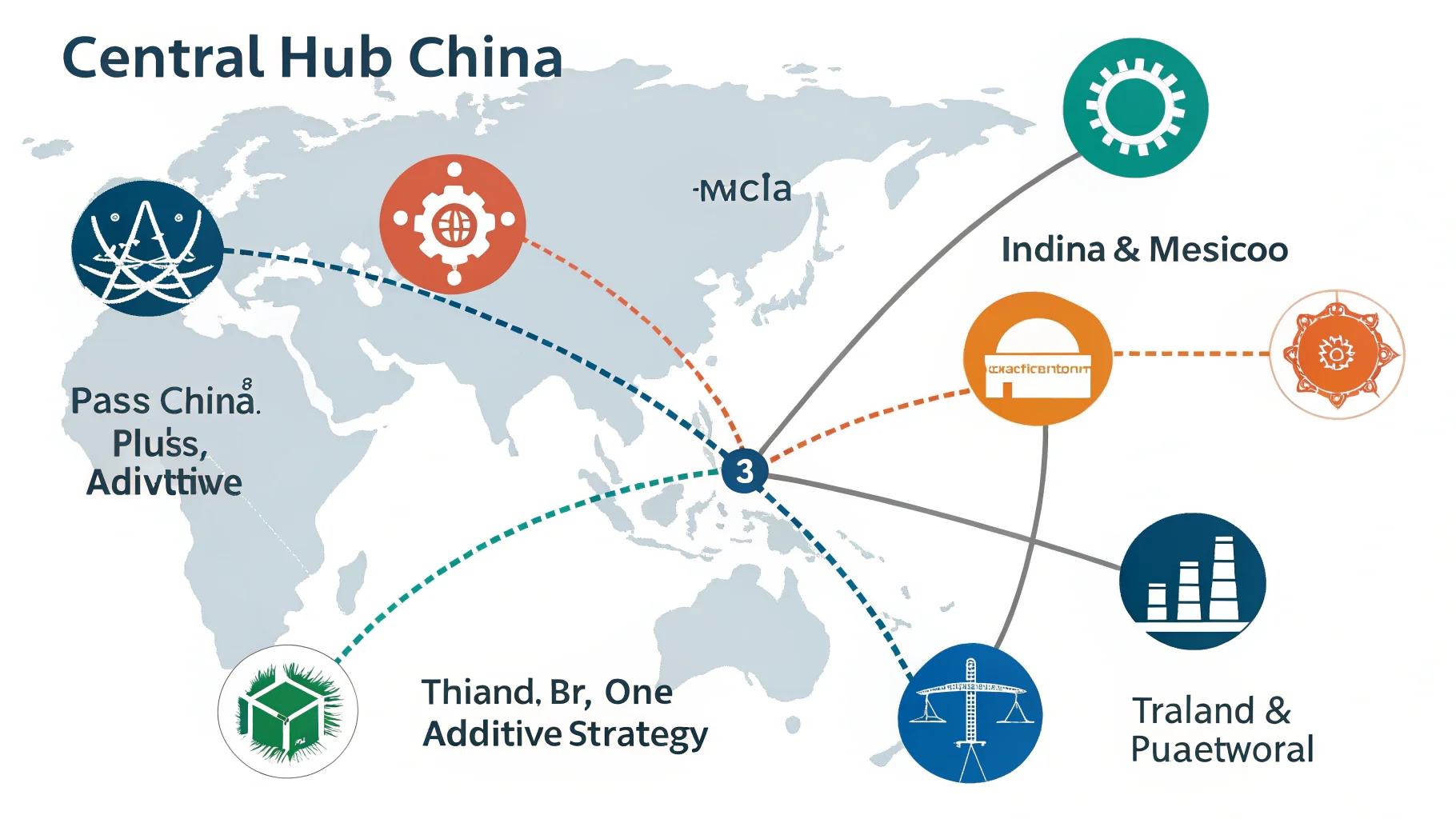

The China+1 strategy is a business approach where you diversify your manufacturing by adding a new operational hub in another country while keeping your existing base in China. It's about building resilience and flexibility1, not completely abandoning your current supply chain.

I remember the panic during the early days of the pandemic. Our entire inventory of air purifier filters was stuck in one city. We promised our customers clean air, but we couldn't deliver. That's when I knew we had to change. We couldn't afford to have a single point of failure. This experience pushed us to explore what it means to build a truly resilient business.

This isn't just about avoiding the next crisis. It's a proactive move to protect your brand, improve your profits, and find new ways to grow. Let's break down what this strategy really means and how you can make it work for your D2C brand.

Over 50% of North American supply chain leaders have already moved or plan to move manufacturing out of China.Verdadeiro

A 2023 survey by Gartner confirmed this trend, highlighting the widespread adoption of supply chain diversification strategies.

The China+1 strategy requires completely shutting down all manufacturing operations in China.Falso

This is a common myth. The strategy is 'additive,' meaning you add a '+1' location while often retaining China for its established infrastructure, skilled labor, or specific components.

1. Introduction: Are You Looking Beyond the "World's Factory"?

Your customers were angry about stockouts and delays. Tariffs ate into your margins. Relying completely on China became a huge liability. It's time to build a more resilient supply chain.

The China+1 strategy is your solution. It’s not about leaving China behind. It’s about smart diversification. For D2C brands2 like ours, this is now a crucial move to boost profitability, keep our brand promises, and get ahead of the competition.

I’ve been there. During the height of the trade wars, a sudden 25% tariff was slapped on one of our core water purifier components. Our margins vanished overnight. We had two choices: absorb the cost and lose money, or pass it on to our customers and risk losing them. We felt trapped. That was our wake-up call. We realized that having all our eggs in one basket, no matter how efficient that basket seemed, was a gamble we couldn't afford to take anymore. This isn't just a theoretical problem; it's a real threat to your bottom line and your brand's reputation. The China+1 strategy is the proactive step we took to regain control.

The US-China trade war resulted in tariffs on over $350 billion worth of Chinese goods.Verdadeiro

These tariffs, implemented since 2018, have significantly increased the cost of importing a wide range of products for US-based companies.

2. What is the China+1 Strategy (And What It's Not)?

You hear "China+1" and think it means packing up and leaving China entirely. This confusion stops many brands from acting. But the strategy is much more flexible and powerful than that.

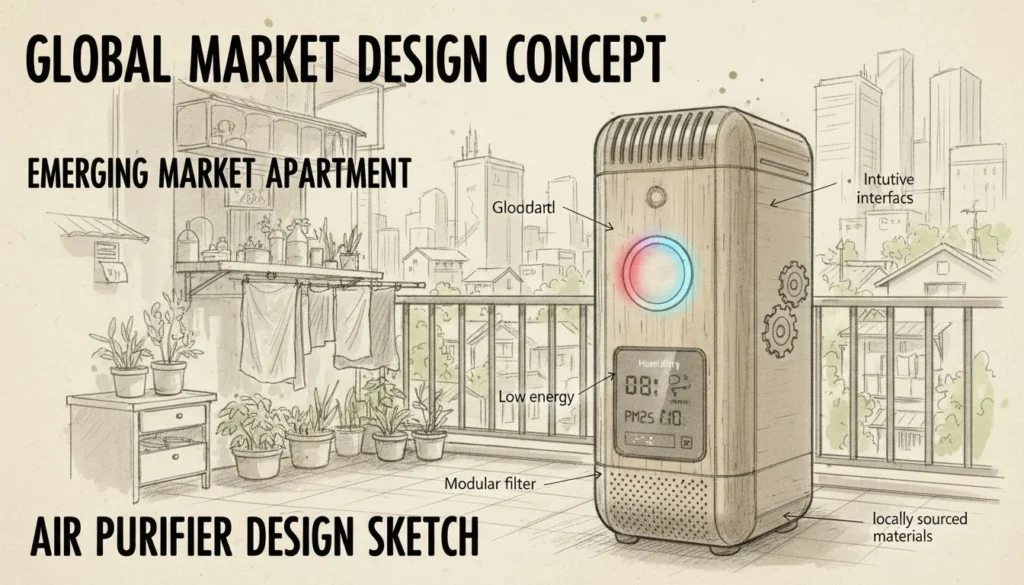

China+1 means keeping China as a key part of your supply chain while adding another manufacturing hub in a different country. It’s an additive strategy. You might make components in China and do final assembly in your "+1" country, creating a stronger, more balanced operation.

This strategy has changed over time. It used to be just about finding cheaper labor. Now, it's about managing risk. Let's look at how this works.

It's Additive, Not a Full Withdrawal

Think of it like a hybrid model. China has an incredible manufacturing ecosystem that is hard to replicate. For many of our HisoAir purifiers, we still source specialized electronic components from our trusted partners in Shenzhen. But we now do the final assembly and quality control3 for our North American market in Mexico. This way, we get the best of both worlds: China's high-tech component manufacturing and Mexico's logistical advantages for serving our US customers. It's not about replacing China, but supplementing it.

The Evolution from Cost to Risk

A decade ago, the conversation was simple: "Where can we make this cheaper?" Today, the question is more complex: "How do we protect our business from the next disruption?" The focus has shifted from pure cost optimization to building resilience.

| Old Approach (Cost-Focused) | New Approach (Risk-Focused) |

|---|---|

| Single-source in the lowest-cost country. | Multi-source to spread risk. |

| Main driver: Lower labor costs. | Main drivers: Resilience, tariff avoidance4. |

| Success metric: Cost per unit. | Success metric: Supply chain stability. |

This shift is critical for D2C brands. Our promise to customers depends on our ability to deliver, and a risk-focused supply chain is the foundation of that promise.

Vietnam's manufacturing labor cost is approximately one-third of China's.Verdadeiro

As of 2023, average factory wages in China are significantly higher than in emerging manufacturing hubs like Vietnam, making cost a driver for diversification.

3. Why Can't Your D2C Brand Afford to Ignore China+1?

You think your current supply chain is fine. But rising costs, trade wars, and sudden lockdowns are ticking time bombs. Ignoring these risks is a direct threat to your business's survival.

Your brand cannot afford to ignore the China+1 strategy because of three key drivers. These are rising economic pressures5 in China, unpredictable geopolitical volatility like tariffs, and the operational nightmare of a single point of failure, which the pandemic brutally exposed.

We learned this the hard way. A sudden lockdown in a single Chinese district halted production of a critical valve for our water purifiers for six weeks. We had no backup. The result was thousands of backorders and a flood of angry customer emails. It damaged the trust we had worked so hard to build. Here’s a deeper look at why you need to act now.

Economic Pressures

China is no longer the world's cheapest factory. Labor costs have been rising for years. More importantly, the country is strategically moving its economy up the value chain. They are focusing on high-tech industries like robotics and EVs, not just simple consumer goods. This means less government support and more competition for the kind of manufacturing many D2C brands rely on. Your brand might become a lower priority.

Geopolitical Volatility

Trade wars and tariffs can appear with little warning. A product that is profitable one day can be a liability the next. This uncertainty makes financial planning impossible. You can't build a sustainable business on a foundation that could crack at any moment due to a political decision made thousands of miles away. Diversification gives you an escape route from this volatility.

Operational Nightmares

The pandemic was the ultimate stress test. It showed that a single point of failure can bring your entire operation to a halt. Stockouts, long delays, and skyrocketing shipping costs became the norm. For a D2C brand, "out of stock" means zero revenue and a lost customer, maybe forever. A diversified supply chain means a disruption in one country doesn't shut you down completely.

China's government is actively discouraging low-value manufacturing in favor of high-tech industries.Verdadeiro

Policies like 'Made in China 2025' clearly outline the country's ambition to become a leader in advanced technology, shifting focus away from traditional, labor-intensive manufacturing.

4. How Does Diversification Directly Benefit Your D2C Brand?

You worry that diversifying is too expensive and complicated. The setup costs seem high, and you fear losing control. But the long-term strategic payoff far outweighs the initial challenges.

Diversification directly benefits your D2C brand by building resilience against disruptions, protecting your profit margins from tariffs and rising costs, and opening up new growth opportunities. It also gives you a powerful brand story about reliability and responsible sourcing.

When we established our assembly in Mexico, we saw an unexpected benefit. We started getting inquiries from retailers in South America. Our new hub wasn't just a backup plan; it became a gateway to a new market we hadn't even considered. The strategic payoffs are real and can transform your business.

Building True Resilience

This is the most obvious benefit. If a factory in Vietnam is shut down by a typhoon, your facility in Mexico can ramp up production. A political issue with China won't stop you from serving your US customers. Resilience means your business keeps running, your revenue keeps flowing, and your customers stay happy, no matter what happens in one part of the world. It turns a potential catastrophe into a manageable problem.

Protecting Your Margins

A China+1 strategy gives you options to protect your bottom line.

- Lower Costs: You can access lower labor costs in countries like India or Thailand for certain products.

- Tariff Avoidance: By assembling or manufacturing in a country like Mexico, your products may not be subject to the same tariffs as goods coming directly from China. This can save you 25% or more right off the top.

Unlocking New Growth and Brand Storytelling

Your new manufacturing hub can double as a distribution center for that region. This allows you to tap into emerging markets faster and more cheaply than your competitors. Furthermore, you can build a brand story around this. You can tell your customers: "We've built a global, resilient supply chain to make sure you always get the products you rely on." This message of reliability is incredibly powerful and builds deep customer trust.

Nearshoring to Mexico can reduce shipping times to the US from 30 days to as little as 5 days.Verdadeiro

Compared to trans-Pacific ocean freight from Asia, ground freight from Mexico offers a significant reduction in transit time, improving inventory turnover and responsiveness.

5. How Do You Put the China+1 Strategy Into Practice?

You know you need to diversify, but the process seems overwhelming. Where do you even start? Taking the first step feels like a huge leap into the unknown.

Start with a clear, four-step plan. First, analyze your products to choose the right "+1" country. Second, recalculate all your costs. Third, rethink your logistics. Finally, take steps to protect your brand quality and intellectual property.

This isn't something you do overnight. For us, it started with a single product line. We did a deep analysis and decided to test assembly in Mexico. It was a learning process, but breaking it down into manageable steps made it possible. Here is the framework we used.

Step 1: Choose Your "+1"

Not all countries are created equal. You need to match the country to your product's needs. Does your product require a lot of skilled labor or a specific raw material?

| País | Principais pontos fortes | Best For... |

|---|---|---|

| Vietname | Established electronics ecosystem, low labor costs. | Electronics, apparel, furniture. |

| México | nearshoring6 to US, USMCA trade benefits. | Automotive, heavy goods, final assembly. |

| Índia | Huge domestic market, skilled engineers. | Pharmaceuticals, chemicals, software. |

| Tailândia | Strong in automotive and electronics, stable infrastructure. | Automotive parts, hard drives, appliances. |

Step 2: Recalculate Your Costs

Don't just look at the factory price (FOB). You need to calculate the total landed cost. This includes shipping, tariffs, insurance, and overhead for managing a new location. Sometimes a cheaper factory price is wiped out by higher logistics costs.

Step 3: Rethink Your Logistics

Nearshoring to Mexico is very different from far-shoring to Vietnam. Nearshoring allows for faster, cheaper ground shipping and smaller, more frequent orders. Far-shoring often requires larger orders and longer lead times. You'll need stronger forecasting and inventory management to handle this.

Step 4: Protect Your Brand

Your brand's reputation is built on quality. You must have a plan for strict quality control in your new factory. Send your own people or hire a trusted third-party inspection service. Also, register your trademarks and patents in your new "+1" country before you start production to protect your intellectual property (IP).

Mexico is the United States' largest trading partner.Verdadeiro

As of 2023, total trade between the US and Mexico surpassed trade with both China and Canada, highlighting its logistical and economic importance.

Registering a trademark in a new country is an automatic, instant process.Falso

Trademark registration is a legal process that varies by country and can take several months to over a year. It requires a formal application and review by the local IP office.

Conclusão

In short, the China+1 strategy is no longer just an option. It's an essential shift from simple cost-cutting to building a resilient, profitable, and future-proof D2C brand.

References

-

Exploring resilience strategies can empower brands to adapt to market changes and crises. ↩

-

D2C brands can benefit from tailored strategies to enhance profitability and customer satisfaction. ↩

-

Implementing effective quality control measures is essential for maintaining product standards and brand reputation. ↩

-

Learning about tariff avoidance can help businesses save costs and improve their bottom line. ↩

-

Understanding economic pressures can help businesses navigate challenges and make informed decisions. ↩

-

Nearshoring can significantly reduce shipping times and costs, enhancing operational efficiency. ↩