Choosing a manufacturing partner1 is a huge decision. A wrong move can sink your business with delays and quality issues. Let's break down the real pros and cons.

The best choice depends on your product and strategy. China offers unmatched technology and scale, ideal for complex products. Vietnam provides lower labor costs and is a great option for diversifying your supply chain. For our water purifiers, we weigh China's tech against Vietnam's potential.

As a brand owner, I get this question a lot. The world of manufacturing is changing fast. The simple answer from five years ago doesn't work anymore. We can't just look at the cost per unit. We have to think about technology, risk, and what our customers care about. I've spent countless hours researching this for my own business, HisoAir. It's a complex puzzle with huge stakes. So, let's walk through the key pieces together, so you can make the best decision for your brand in the coming year.

Vietnam's manufacturing labor costs are less than half of China's.True

On average, China's hourly manufacturing wage is significantly higher than Vietnam's, making Vietnam attractive for labor-intensive production.

All manufacturing is leaving China for Vietnam.False

While many companies are diversifying, China remains the world's largest manufacturer due to its advanced infrastructure, skilled labor, and massive domestic market. It's a diversification trend, not a total exodus.

Why is China Still the Manufacturing Giant?

Worried about rising costs in China? You see headlines about companies leaving. But the full story is more complex and might surprise you. Let's look at why it's still a top choice.

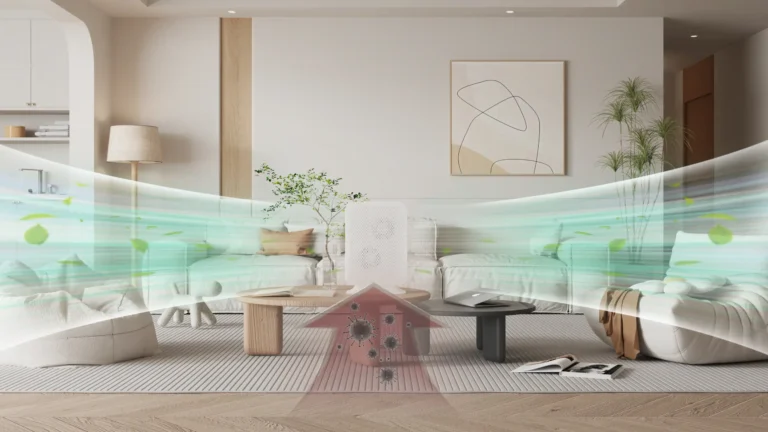

China remains a powerhouse because of its incredible infrastructure, skilled workforce, and massive investment in automation. For products needing precision and advanced tech, like our purifiers, it's often still the top choice, despite higher labor costs.

When I look at manufacturing for HisoAir, I see that China isn't just competing on cost anymore. It's competing on technology and skill. The country has poured billions into upgrading its factories.

The Power of Automation and Skill

China is leading the way in smart factories. They use robotics and AI to make production faster and more consistent. This helps offset their rising labor costs. For a product like a water purifier, where every component must be perfect, this level of automation is a huge advantage. It reduces human error and ensures high quality. On top of that, China has a massive pool of experienced engineers and technicians. If you need to develop a complex new product, the talent to help you do it is right there. This is a major reason why companies making electronics, machinery, and high-tech goods stay in China.

Unmatched Infrastructure

The logistics in China are simply on another level. The network of ports, like the massive Port of Shanghai, highways, and high-speed rail is incredibly efficient. This means you can get raw materials to the factory and finished goods to the port faster than almost anywhere else. While bottlenecks can happen, the system's overall capacity is enormous. This maturity means fewer surprises and more predictable shipping schedules, which is critical for keeping our D2C customers happy.

Is Vietnam the New 'Workshop of the World'?

Everyone is talking about the "China Plus One" strategy. Vietnam is the star of that conversation. But is the hype real for your brand, or are there hidden challenges?

Vietnam is a strong contender due to its lower labor costs, young workforce, and favorable trade agreements. It's an excellent option for simpler products or for brands looking to diversify their supply chain away from total reliance on China.

The appeal of Vietnam is undeniable, and we've seriously considered it. The country has a young, eager workforce, and the government is actively attracting foreign investment. It feels like a land of opportunity.

The Labor Cost Advantage

The most obvious benefit is the cost of labor. It's significantly lower than in China. For products that require a lot of hands-on assembly, like apparel, footwear, or simpler electronics, this can lead to major savings. This is the primary driver for many companies making the move. Vietnam's workforce is also one of the youngest in Southeast Asia, which promises a long-term supply of labor. However, this reliance on manual work can sometimes mean less consistency compared to the highly automated factories in China.

Growing Pains: Infrastructure and Skills

Vietnam is racing to catch up, but it's not China. Its ports in Hai Phong and Ho Chi Minh City are expanding, but they don't have the capacity of Shanghai or Shenzhen yet. This can lead to congestion and delays. The talent pool is also different. While the workforce is large, there's a smaller supply of highly skilled engineers and technicians for really complex manufacturing. Training programs are improving, but for a brand that needs advanced R&D or intricate production processes, finding the right factory with the right skills can be a challenge. It's a trade-off between lower costs and a less mature ecosystem.

Vietnam has one of the fastest-growing economies in Southeast Asia.True

Vietnam has consistently posted high GDP growth rates over the past decade, driven by exports and foreign direct investment in its manufacturing sector.

Vietnam's IP protection laws are more established than China's.False

While improving, Vietnam's legal framework and enforcement for Intellectual Property (IP) are still considered less mature than China's, which has been strengthening its IP courts and laws in recent years.

What Key Factors Should Your D2C Brand Weigh for 2025?

It's not just about cost per unit. Hidden factors can make or break your profitability. Are you considering currency, IP protection, and how your customers see your brand?

You must look beyond the factory floor. Consider currency stability, intellectual property protection2, and how "Made In" affects your brand image. These factors directly impact your bottom line and brand risk, especially for innovative products like ours.

As a D2C brand, we are connected directly to our customers. This means every decision we make is under a microscope. I've learned that the "soft" factors are just as important as the hard costs. A currency swing can wipe out your profit margin. A copied design can destroy your competitive edge. And a negative brand perception can cost you customers. That's why we have to dig deeper.

Here is a simple breakdown of some of the most critical factors I consider for HisoAir.

| 요인 | 중국 | 베트남 |

|---|---|---|

| IP Protection | Improved enforcement, but risks remain for innovative products. More mature legal system. | Still developing. Enforcement can be inconsistent, posing a higher risk for new designs. |

| Currency | The Yuan (RMB) is relatively stable but influenced by major geopolitical trade policies. | The Dong (VND) is weaker, which can benefit exporters, but it's more prone to fluctuation. |

| 지속 가능성 | Facing huge pressure to go green. Compliance costs may rise, but "green" factories are emerging. | Attracting green investment, but struggles with energy shortages and a heavy reliance on coal. |

| 소비자 인식 | "Made in China" is known for scale and tech, but can carry negative political or quality baggage. | "Made in Vietnam" often feels fresh and agile. It can appeal to consumers looking for alternatives. |

A weaker local currency always makes exporting cheaper.False

While a weaker currency makes your goods cheaper for foreign buyers, it also increases the cost of any raw materials or components you have to import, which can offset the benefit.

China has specialized IP courts to handle patent and trademark disputes.True

China has established specialized intellectual property courts in major cities like Beijing, Shanghai, and Guangzhou to improve the handling and enforcement of IP cases.

Should You Choose One Country or Diversify Your Supply Chain?

Putting all your eggs in one basket is risky. We all learned that during the pandemic. So, what does a smart, resilient supply chain look like for 2025 and beyond?

A "China + 1" strategy, often with Vietnam as the "+1," is becoming the new standard for risk management. Some brands are even exploring a "China + Vietnam + Nearshoring" model to build ultimate resilience and speed.

The biggest lesson of the last few years is that resilience is everything. A single point of failure can shut down your entire operation. That's why the conversation has shifted from "China 또는 Vietnam" to "China 그리고 Vietnam." This is the famous "China Plus One" strategy. The idea is to not be completely dependent on one country. You can keep your complex, high-tech production in China to leverage its strengths in automation and engineering. Then, you can move assembly or the production of simpler products to Vietnam to take advantage of lower labor costs.

This hybrid model gives you a backup plan. If one country faces lockdowns, port closures, or new tariffs, you can ramp up production in the other. It spreads your risk. But now, some brands are taking it a step further. They are looking at nearshoring as a third pillar. For a U.S. brand, that might mean adding a manufacturing partner in Mexico. For a European brand, it could be Eastern Europe. This doesn't just add resilience; it can dramatically cut down shipping times and costs for your home market. The ultimate strategy might be using Asia for scale and nearshoring for speed and flexibility.

Nearshoring to Mexico is always cheaper than manufacturing in Asia.False

While shipping is faster and cheaper from Mexico to the U.S., Mexico's labor and operational costs can be higher than in some parts of Asia, making the total landed cost variable depending on the product.

Diversifying a supply chain can help a business mitigate risks from tariffs and trade disputes.True

By not relying on a single country, companies can shift production to avoid the impact of tariffs or geopolitical tensions, making their supply chain more resilient.

결론

The China vs. Vietnam debate has no single answer. The best choice depends on your product's complexity, your risk tolerance, and your long-term brand strategy for 2025.