Your P&L sheet is bleeding from hidden costs1 you can't trace. Product returns and bad reviews are piling up. It's time to look at the real source: your manufacturing partner.

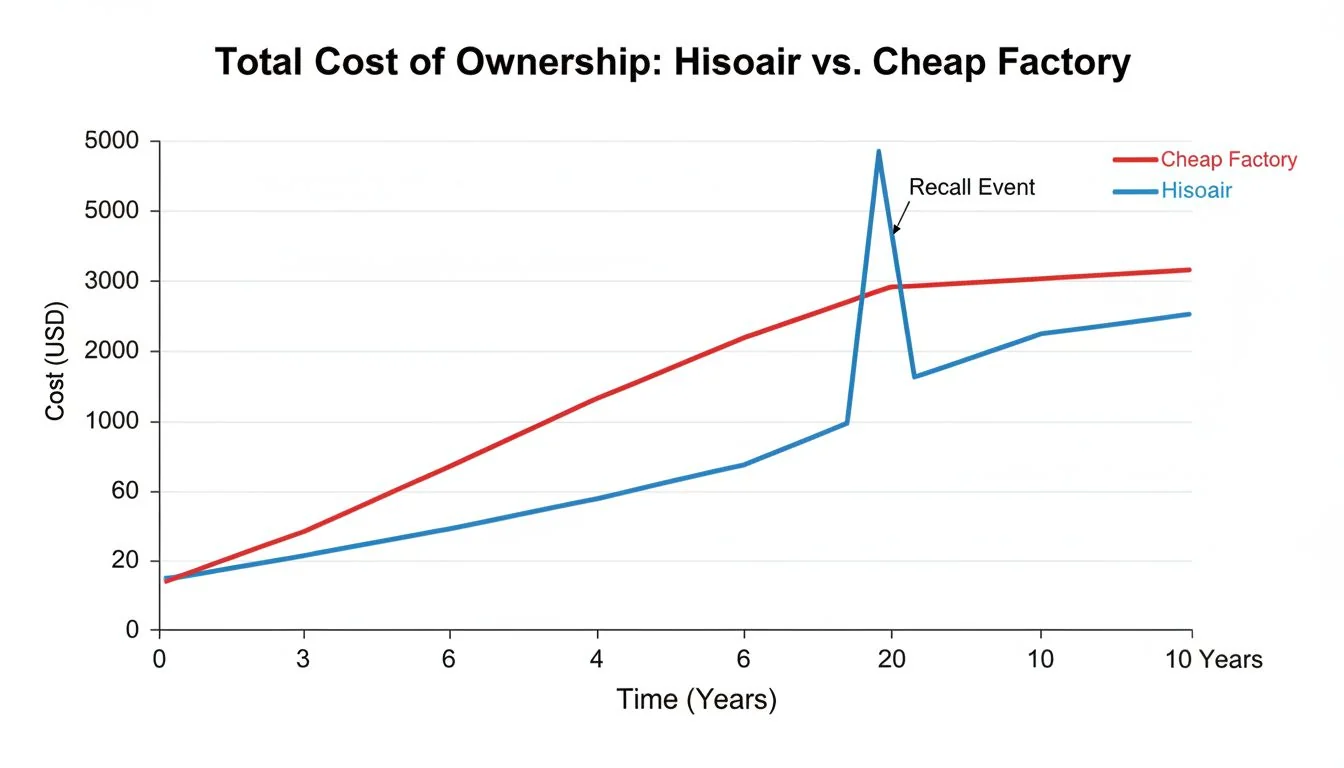

Premium brands choose certified manufacturers because it's a strategic investment in risk management. It lowers the "Total Cost of Ownership2" by eliminating catastrophic expenses from recalls, lawsuits, and brand damage, ensuring guaranteed market access and long-term profitability. It's not an expense; it's insurance.

I've been in this industry for a long time, from the factory floor to running my own trading company. I've seen brilliant products fail. It was almost never because of a bad design. It was because the business leaders were looking at the wrong numbers. They were obsessed with the per-unit price from the factory. They didn't understand that the most important number isn't on the invoice. It's the hidden number, the cost of what could go wrong. Today, I want to pull back the curtain on this and show you how to think like the most successful brands I've worked with. It's time to redefine "cost" and protect your business.

The 'Cost of Poor Quality' can amount to 15-20% of a company's sales revenue.True

According to the American Society for Quality (ASQ), many companies spend 15-20% of their revenue on costs associated with poor quality, including rework, scrap, warranty claims, and lost sales.

Choosing the cheapest manufacturer always leads to higher profits in the long run.False

This is a common misconception. The initial savings are often erased by higher costs related to product failures, recalls, reputational damage, and lost customers, resulting in a lower Total Cost of Ownership.

What Are the Two "Costs" of Manufacturing You Must Know?

You're only looking at the price tag on the quote. This narrow focus blinds you to the hidden expenses that can destroy your budget and your brand. See the full picture.

The two fundamental costs are the "Cost of Low Quality" and the "Cost of Quality." The first is the unplanned, reactive cost of failure. The second is the planned, proactive investment3 in prevention.

In my early days, I helped a client source a new electronic gadget. They went with the cheapest factory, saving about 15% on the unit price. They felt like heroes. But they didn't understand the two costs. They were only looking at one.

The Price Tag You See

This is the "Cost of Quality." It's the money you intentionally spend to make sure things go right. It's an investment. This includes paying a bit more for a factory that has its certifications in order, uses better materials, and has rigorous testing protocols. It shows up on the P&L sheet as a clear, predictable expense. You are buying certainty.

The Hidden Bill You Pay Later

This is the "Cost of Low Quality." It's the money you are forced to spend when things go wrong. It's unpredictable and often catastrophic. This is the cost of product recalls, customer returns, legal fees when a product fails, and the permanent damage to your brand's reputation. This cost never appears on the initial quote.

| Cost Type | 설명 | 예 |

|---|---|---|

| Cost of Quality | Proactive investment to prevent failure. | Paying for a factory with ETL certification. |

| Cost of Low Quality | Reactive expense to fix failure. | Paying for a product recall after a fire hazard. |

Proactive quality control is 10 times more effective than reactive problem-solving.True

Industry studies, including principles from Total Quality Management (TQM), show that preventing a defect is significantly cheaper and more effective than finding and fixing it after it has occurred.

All manufacturing costs are listed on the factory's initial price quote.False

The initial quote only covers the direct costs of production. It does not include the potential 'Cost of Low Quality,' such as warranty, returns, recalls, and reputational damage, which can be far greater.

Are You Walking into the Uncertified Factory Trap?

That uncertified factory's quote looks incredibly low. But this tempting offer can lead to your products being seized at the border and your brand facing legal action. Recognize this trap.

The "uncertified factory trap" is when you choose a partner based on a low unit price, ignoring their lack of certifications. This decision exposes you to massive hidden costs from product failures, market access4 denial, and brand-destroying reviews.

I saw this happen to a promising startup. They found a factory that quoted them 30% less than anyone else for a home air purifier. The catch? The factory had no CARB or EPA certifications. The client thought they could "deal with it later." Their first shipment was stopped by customs. The entire container was rejected because it wasn't compliant with U.S. air quality regulations. The "savings" they celebrated vanished instantly, replaced by a total loss.

The Domino Effect of a Single Failure

A lack of certification isn't just a paperwork problem. It's a giant red flag that signals a lack of discipline, quality control5, and respect for standards. This mindset leads to failures.

Why "Cheap" Becomes Expensive

The trap is sprung the moment you have a problem. Without the backing of a certified process, you have no ground to stand on.

| Risk of Uncertified Partner | Consequence for Your Business |

|---|---|

| Market Access Denial | Entire shipments can be rejected at the border (e.g., no ETL, UL). |

| Forced Product Recalls | Regulators can force you to recall unsafe products from shelves. |

| Lawsuits & Liability | You are liable if an uncertified product harms a customer. |

| Negative brand reputation6 | A single safety incident can lead to 1-star reviews and lost trust. |

In the U.S., all electrical products sold must be tested and certified by a Nationally Recognized Testing Laboratory (NRTL).True

OSHA regulations require that many types of electrical equipment be certified by an NRTL, like UL or ETL, to ensure they meet safety standards before being sold or used in the workplace.

Certifications are optional guidelines that don't affect market access.False

For many product categories and markets (like electronics in the US/Canada or products affecting air quality in California), certifications like ETL, UL, and CARB are mandatory legal requirements for market entry.

Why is the 'Cost of Quality' an Investment, Not an Expense?

You see quality control on your budget and think it's a cost to be minimized. This thinking invites risk and cuts the wrong corners. Reframe quality as a direct investment in your brand's survival.

The "Cost of Quality" is an investment because the money you spend upfront prevents much larger, unpredictable costs later. It's a calculated payment for reliability, market access, and brand protection, which delivers a clear return.

Think of it like insurance for your house. You pay a monthly premium. That premium is a predictable cost. You don't see it as "wasted money." You see it as protection against a catastrophic event, like a fire, that could wipe you out completely. The Cost of Quality works the same way for your brand.

Paying Now vs. Paying Much More Later

Spending a little more for a certified manufacturer is your insurance premium. You are paying to avoid the "fire" of a product recall, a lawsuit, or getting blacklisted from a major market. The small extra per-unit cost is tiny compared to the multi-million dollar cost of a full-scale disaster.

Building a Moat Around Your Brand

This investment builds a protective moat around your brand. When a competitor using a cheap factory gets hit with a recall, your product stays on the shelf. When customers search for a reliable product, your brand, known for its quality, is the one they choose. This is how you win in the long run.

| The Investment | The Return (ROI) |

|---|---|

| Using a certified factory | Guaranteed market access, no customs rejection. |

| Higher-grade materials (e.g., stainless steel) | Fewer returns, no 1-star "mold" reviews. |

| Rigorous testing protocols | Lower warranty claim costs, higher customer loyalty. |

| Total Quality Investment | Higher Brand Equity & Long-Term Profitability |

Companies with strong quality management systems can see a return of $6 for every $1 invested in quality.True

Studies by organizations like the Aberdeen Group have shown that best-in-class companies that invest in Quality Management Systems (QMS) see significant returns through reduced costs, improved efficiency, and increased customer satisfaction.

Spending on quality control reduces a company's net profit.False

While it is an upfront cost, effective spending on quality control is an investment that prevents larger losses from failures, thereby protecting and often increasing net profit over the long term.

You might think "premium" just means a nice finish or better packaging. But what good is a premium product if it's illegal to sell? It's time to see why certification is the real mark of a premium partner.

Yes, certification is the new definition of premium. It is the ultimate proof that a manufacturer adheres to critical safety, quality, and environmental standards. It's a non-negotiable guarantee that protects your brand and ensures market access.

For years, brands competed on features. Now, the smartest brands compete on trust. As a C-suite executive or business owner, your biggest risk isn't a competitor with a slightly better feature. Your biggest risk is your entire product line being pulled from the market overnight. This is why the conversation has shifted.

Certification as Your "Market Access Insurance"

When I vet a new factory for a client, the first things I ask for are their certifications. Not their price list. Certifications like ETL, CARB, and EPA are not "nice-to-haves." They are a paid-in-full insurance policy that guarantees your product can be sold legally and safely. A partner without them is not a "budget" option; they are an "uninsurable" risk.

The Physical Proof of Premium: Stainless Steel

If certifications are the "market insurance," then the right materials are the "brand insurance." For many products, the single most damaging 1-star review is about mold. It kills consumer confidence instantly. Using a material like stainless steel is the physical proof of quality that solves this problem before it starts. It's a tangible feature that tells the customer you invested in a product that will last and stay clean.

| 인증 | Risk It Mitigates | Type of Insurance |

|---|---|---|

| ETL/UL | Electrical fire, safety hazards, lawsuits. | Market & Liability Insurance |

| CARB/EPA | Air quality violations, being banned from states like California. | Market & Environmental Insurance |

| Stainless Steel | Mold, rust, degradation, 1-star reviews. | Brand Reputation Insurance |

The California Air Resources Board (CARB) can fine companies up to $45,000 per day for selling non-compliant products.True

CARB has strict regulations for products that emit air contaminants, and violations can lead to significant financial penalties, making compliance a critical business requirement for selling in California.

Stainless steel is purely a cosmetic choice with no functional benefit.False

Stainless steel's corrosion and rust resistance make it highly effective at preventing mold and bacterial growth, a critical functional benefit for products in humid environments, directly protecting brand reputation.

You see Hisoair's quote, and it's not the rock-bottom price. This makes you hesitate. But focusing on that number alone means you're missing the most important part of the calculation.

A premium partner like Hisoair delivers the "lowest total cost" by being the "lowest risk" partner. Their upfront investment in certifications and quality eliminates the huge, hidden costs of failure, making them the most profitable and secure choice in the long run.

This is the conversation I have with CEOs and COOs. We don't talk about per-unit price. We talk about risk management7 and brand equity. A cheap factory sells you a product. A strategic partner like Hisoair sells you business continuity. They understand that their job is to protect your P&L and your brand's future.

Shifting from Price to Value

The value of a low-risk partner is immense. It's the value of sleeping at night knowing your products won't be recalled. It's the value of positive customer reviews that build your brand, instead of tearing it down. It's the value of having 100% of your inventory clear customs without a single issue. This value far outweighs a small difference in unit price.

The C-Suite Calculation

The smart leader doesn't ask, "How much does it cost?" They ask, "What is the cost of failure, and what is the probability of failure?" A premium, certified partner drives the probability of failure to near zero.

| 요인 | Cheap Uncertified Factory | Hisoair (Certified Partner) |

|---|---|---|

| Upfront Unit Cost | 낮음 | 더 높음 |

| Risk of Recall | 높음 | Near-Zero |

| Risk of Market Rejection | 높음 | Near-Zero |

| Brand Reputation Risk | 높음 | 낮음 |

| Total Cost of Ownership | Extremely High & Unpredictable | Predictable & Lower |

Brand equity can account for more than 50% of a company's stock market value.True

Studies in marketing and finance have shown that for many top companies, the intangible asset of brand equity is one of their most valuable, significantly influencing market valuation and customer loyalty.

A low-risk strategy is always more expensive than a low-price strategy.False

A low-price strategy often carries high hidden risks. A low-risk strategy, while potentially having a higher initial cost, prevents catastrophic expenses, making it the less expensive option when considering the Total Cost of Ownership.

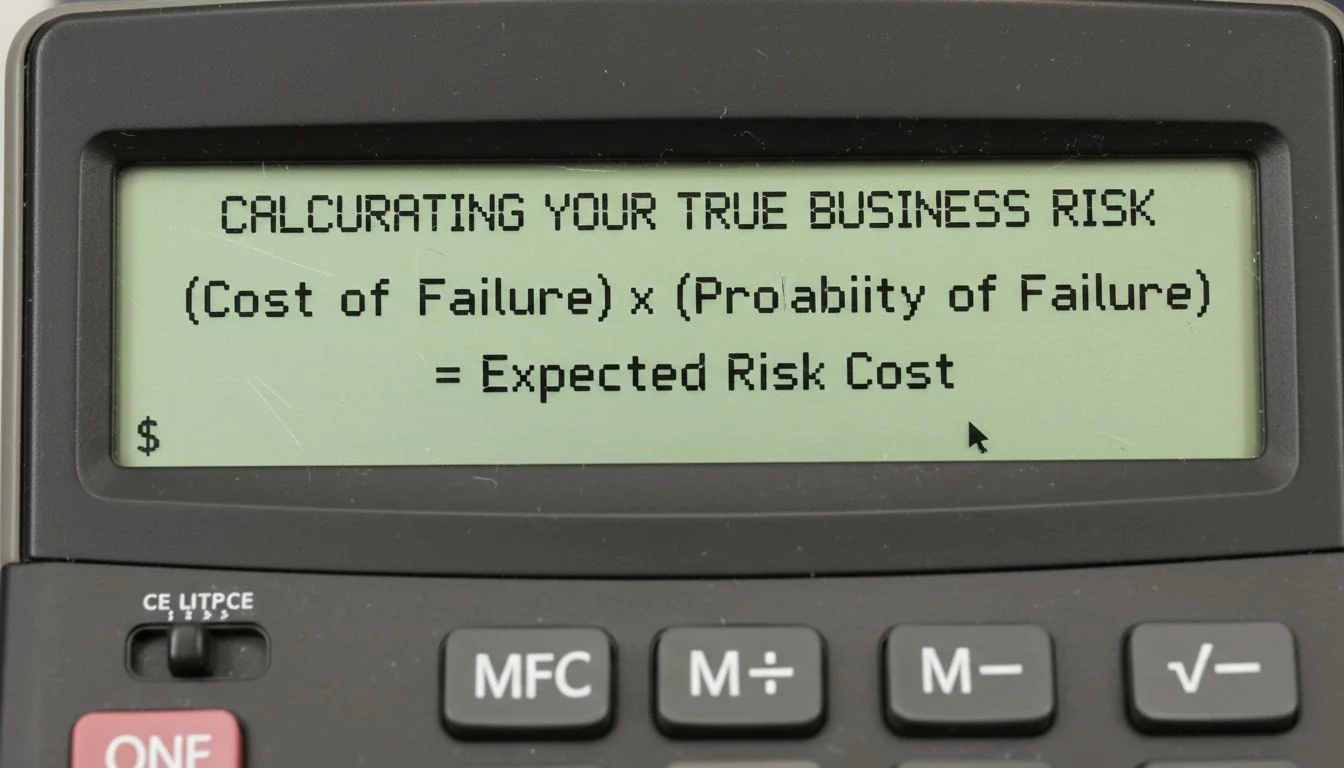

Should You Calculate Your Risk, Not Just Your Price?

Your spreadsheet is filled with per-unit costs down to the last cent. But this detailed sheet completely ignores your single biggest financial threat: the cost of failure.

Yes, you must calculate your risk. A low-risk partner protects your brand, ensures market access, and prevents catastrophic expenses. This makes them the partner with the lowest total cost, which is the only number that truly matters.

Let's stop thinking like a purchasing manager from the 1990s and start thinking like a modern business strategist. The game has changed. It's no longer about shaving pennies off the unit price. It's about eliminating existential threats to your business.

A Simple Risk Calculation

You don't need a complex algorithm. Just think it through. What would a full product recall cost you? $1 million? $5 million? Now, what is the probability of that happening with a cheap, uncertified factory? Maybe 10%? 20%? Even at 10%, your "Expected Risk Cost" is $100,000 to $500,000. Now, what's the probability with a fully certified, premium partner like Hisoair? It's near zero. The risk cost vanishes. Suddenly, their slightly higher unit price looks like the best bargain you've ever seen.

Your Next Move

Take this logic to your next sourcing meeting. When someone presents the "cheapest" option, ask them: "What's the cost of failure, and what have you calculated as our risk cost?" This one question changes the entire conversation. It elevates the discussion from price to strategy. It's how you build a resilient, premium brand that lasts.

| Decision Factor | Old Way (Price-Focused) | New Way (Risk-Focused) |

|---|---|---|

| Primary Metric | Per-Unit Cost | Total Cost of Ownership (TCO) |

| Key Question | Who is the cheapest? | Who is the lowest risk? |

| Partner Vetting | Based on price quotes. | Based on certifications and quality systems. |

| Outcome | High risk, potential for catastrophic loss. | Low risk, long-term profitability and brand safety. |

Risk management is now considered a core responsibility of a company's board of directors.True

Corporate governance standards globally (e.g., from the NYSE, COSO framework) mandate that the board has oversight of the company's risk management processes, elevating it from a departmental task to a strategic imperative.

Calculating risk is too complex for most businesses.False

While complex models exist, a basic and highly effective risk calculation can be done with a simple framework: estimating the potential cost of a negative event and multiplying it by its estimated likelihood.

결론

Stop chasing the lowest price. The smartest brands invest in low-risk, certified partners. This protects your brand, guarantees profitability, and gives you peace of mind. It's that simple.

References

-

Identifying hidden costs can help businesses avoid unexpected expenses that can harm profitability. ↩

-

Understanding TCO helps businesses make informed decisions that prevent hidden costs and ensure long-term profitability. ↩

-

Proactive investments in quality and certifications can lead to long-term savings and brand loyalty. ↩

-

Certifications are crucial for legal compliance and market entry, ensuring products can be sold without issues. ↩

-

Quality control is essential for maintaining product standards and preventing costly recalls and customer dissatisfaction. ↩

-

A strong brand reputation is built on quality; understanding this link can help businesses prioritize their manufacturing choices. ↩

-

Effective risk management strategies can safeguard businesses from potential losses and enhance operational stability. ↩