Choosing where to manufacture your product is one of the most critical decisions your business will make. For decades, the answer was simple: China. But the global landscape has shifted dramatically. Escalating trade tensions, the supply chain vulnerabilities exposed by the pandemic, and rising costs have forced businesses to rethink their strategies. The question is no longer just "how cheap can I make it?" but "how resilient, agile, and secure is my supply chain?"

This new paradigm has pushed two major contenders into the spotlight alongside the incumbent: Vietnam and Mexico. Each offers a unique value proposition, turning a once-straightforward choice into a complex strategic decision. This guide will break down the strengths and weaknesses of each country to help you determine the best fit for your business.

The End of an Era: Why Businesses Are Looking Beyond China

The move away from a single-source dependency on China is a strategic shift known as the "China Plus One" model. This isn't about abandoning China entirely, but about diversifying and de-risking operations. Several key factors are driving this trend:

- Eroding Cost Advantages: China's economic growth has led to a significant increase in manufacturing wages. Labor costs in major hubs have climbed, narrowing the once-vast gap with other nations.

- Geopolitical Tensions and Tariffs: The U.S.-China trade war has introduced unpredictable tariffs of 25% or more on a wide range of goods, creating massive uncertainty for businesses serving the American market. This, combined with a more challenging business climate for foreign firms, has made long-term investment riskier.

- Supply Chain Resilience: The COVID-19 pandemic was a wake-up call, revealing the dangers of a hyper-centralized supply chain. Lockdowns and shipping bottlenecks crippled global production, forcing companies to prioritize shorter, more agile, and geographically diverse supply networks to withstand future shocks.

A Head-to-Head Comparison: China vs. Vietnam vs. Mexico

To make an informed decision, it's essential to compare these locations across the factors that matter most: cost, capability, logistics, and risk.

1. Labor Costs and Workforce

While labor is a major expense, the sticker price of hourly wages doesn't tell the whole story. Productivity, skill level, and availability are just as important.

- China: No longer the cheapest option, with average manufacturing wages between \$6.50 and \$8.50 per hour. However, its workforce is massive, highly skilled, and exceptionally productive, backed by decades of experience and advanced automation. For complex, high-volume production, China's efficiency is hard to beat.

- Vietnam: The clear winner on raw labor costs, with average manufacturing wages around \$2.50 to \$3.50 per hour. Its workforce is young, large, and adaptable, making it a magnet for labor-intensive assembly, particularly in electronics and textiles. However, productivity in more technical sectors can still lag behind China and Mexico, which can eat into some of the cost savings.

- Mexico: Occupies the middle ground, with hourly wages typically ranging from \$3.50 to \$5.00. Its key advantage is a highly skilled and experienced workforce in advanced manufacturing, especially in the automotive and electronics industries. Higher productivity rates often make its "fully loaded" labor cost very competitive with Vietnam for more complex products.

2. Supply Chain, Infrastructure, and Ecosystem

A factory is only as good as the network that supports it. The ability to source components, access reliable infrastructure, and tap into a mature industrial ecosystem is critical.

- China: This is China's undisputed superpower. It boasts a vast, deep, and highly integrated supply chain for virtually any component imaginable, from basic plastics to advanced semiconductors. Its infrastructure—ports, highways, and rail—is world-class, enabling massive scale and efficiency.

- Vietnam: This is Vietnam's most significant weakness. The country is heavily dependent on imported raw materials and electronic components, with over 40% coming from China. This means a "Made in Vietnam" label often hides a Chinese-made core, exposing businesses to the same potential disruptions. While its infrastructure is rapidly improving, ports and roads can face bottlenecks, limiting scalability.

- Mexico: Mexico's supplier network is mature and growing, particularly in the automotive and electronics sectors. Its infrastructure is considered superior to Vietnam's and is built to serve the demanding North American market. A key advantage is the IMMEX (Maquiladora) program, which allows for the duty-free temporary importation of components and machinery for export manufacturing, significantly reducing costs and administrative hurdles.

3. Logistics, Tariffs, and Speed-to-Market

For businesses selling into the U.S., the cost and time it takes to get your product to your customer can make or break your profitability.

- China: Faces the longest lead times, with ocean freight to the U.S. taking 30-40 days. It is also the primary target of U.S. tariffs, with duties of 25-30% or more making many products uncompetitive.

- Vietnam: Offers slightly better ocean transit times of 18-35 days. However, it faces a new U.S. tariff structure: a 20% duty on Vietnamese goods and a punishing 40% tariff on products deemed to be "transshipped" from China—a major risk given its supply chain dependency.

- Mexico: This is Mexico's game-changing advantage. Proximity to the U.S. allows for ground transportation by truck, cutting lead times to a mere 3-7 days. This incredible speed allows for leaner inventories, faster response to market demand, and reduced working capital tied up in transit. Critically, under the United States-Mexico-Canada Agreement (USMCA), goods that meet rules of origin can enter the U.S. market completely duty-free, providing a massive and predictable financial advantage.

4. Business Environment and Risk Mitigation

Long-term success depends on a stable and predictable environment where your investments and intellectual property are safe.

- China: Represents the highest risk profile. Intellectual property (IP) theft remains a persistent and significant concern for foreign companies. The ongoing geopolitical friction with the U.S. creates a volatile and uncertain operating environment.

- Vietnam: Carries a medium risk. Its legal framework for IP protection operates on a "first-to-file" principle, which can expose foreign brands to "trademark squatting" if they don't register their IP in Vietnam early. Enforcement can also be inconsistent. While politically stable, its economy is caught in the middle of the U.S.-China rivalry.

- Mexico: Offers the lowest risk for companies serving North America. As a partner in the USMCA, Mexico's legal framework for IP protection is robust and largely aligned with U.S. standards, offering much stronger safeguards. The trade relationship is stable and governed by a formal agreement, insulating it from the tariff volatility seen in Asia.

Making the Right Choice for Your Business

So, which country is the winner? The answer depends entirely on your company's specific priorities, product, and target market.

Choose China if:

- Your primary need is massive scale and access to the world's most comprehensive and cost-effective component supply chain.

- Your product is highly complex and requires a deep well of manufacturing expertise.

- Your primary market is not the United States, allowing you to avoid the most severe tariffs.

Choose Vietnam if:

- Your top priority is achieving the absolute lowest direct labor cost for assembly-intensive products.

- You are serving European or other Asian markets, where you can leverage Vietnam's numerous free trade agreements.

- You have a strategy to manage the risks of a dependent supply chain and potential U.S. transshipment tariffs.

Choose Mexico if:

- Your primary market is the United States or Canada.

- Speed-to-market, supply chain agility, and resilience are your top priorities.

- You want to eliminate tariff uncertainty and benefit from duty-free access to the U.S.

- Your product involves valuable intellectual property that requires strong legal protection.

Conclusion

The global manufacturing map has been redrawn. The simple, cost-based decision to manufacture in China has been replaced by a complex strategic equation that must balance cost, speed, resilience, and risk. China remains a manufacturing titan with unparalleled capabilities, but its advantages are being offset by rising costs and geopolitical headwinds. Vietnam has emerged as a compelling low-cost alternative, but it comes with significant supply chain vulnerabilities.

For many businesses, particularly those focused on the North American market, Mexico now presents the most balanced and strategically sound proposition. Its unbeatable logistical speed, insulation from tariffs via the USMCA, and a mature manufacturing ecosystem offer a powerful combination of agility and security that is increasingly vital in today's uncertain world.

Ultimately, the best choice is the one that aligns with your unique business goals and prepares you not just for today's market, but for the challenges of tomorrow.

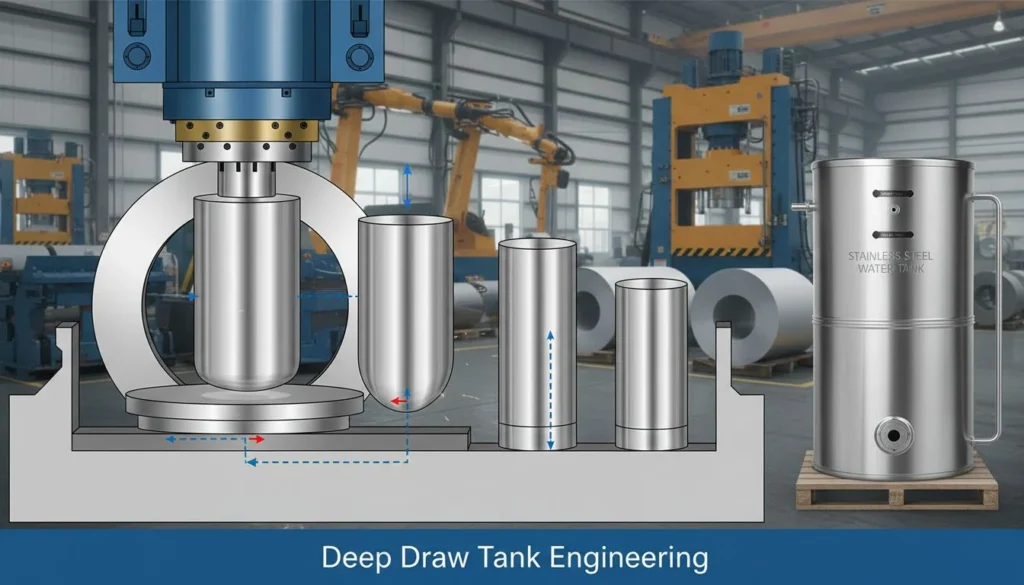

However, it’s important to note that not all Chinese suppliers carry the same risks. Some manufacturers, such as HisoAir, operate as trusted ODM/OEM partners under strict Non-Disclosure Agreements (NDAs). They collaborate with clients to co-develop innovative products while ensuring strong IP protection and confidentiality. For brands that still want to leverage China’s vast supply chain but minimize risk, HisoAir provides a reliable, secure, and innovation-driven alternative.